Ch.4 Retirement and Death of a Partner .

- The ratio in which the continuing partners share the profit of outgoing partner is called______.

Ans : (b) Gaining Ratio

(a) Old Ratio (b) Gaining Ratio (c) Sacrificing Ratio (d) New Ratio - New ratio – Old ratio = _______

(a) Sacrificing ratio (b) Current ratio(c) Gaining ratio d) None of these

Ans : (c) Gaining ratio - Give journal entries for the following :

(a) The amount due to retiring partner is paid cash in full.

(b) When the amount due to retiring partner is transferred to his loan account.

Ans : (a) Retiring partner’s Capital A/c Dr

To Cash / Bank A/c

(b) Retiring partner’s Capital A/c Dr

To Retiring partner’s loan A/c

- Najeeba, Sherin and Nasar are equal partners. Nasar decides to retire. On the date of his retirement, the Balance Sheet of the firm showed a General Reserve of ` 40,000 and Profit and Loss Account ` 20,000 (Dr.)

Show the accounting treatment for the above.

Ans :a) General Reserve A/c Dr 40000

To Najeeba Capital A/c 13333

To Shering Capital A/c 13333

To Nasar Capital A/c 13334

b) Najeeba Capital A/c 6666

Shering Capital A/c 6666

Nasar Capital A/c 6667

To P&L A/c 20000

- Sruthi, Aleena and Febina are partners in the ratio of 3 : 2 : 1. Sruthi retires and her share is acquired by the remaining partners in the ratio of 3 : 2. Calculate the new ratio.

Ans : New Ratio 19:11 - ‘M’, ‘N’ and ‘O’ are equal partners. M decides to retire from the firm. On the date of his retirement the Balance Sheet of the firm showed the following :

(a) Profit and Loss Account (Dr.) ` 12,000.

(b) General Reserve ` 48,000.

Pass necessary journal entries to record the above.

Ans : a) M Capital A/c Dr – 4000

N Capital A/c Dr – 4000

O Capital A/c Dr – 4000

To Profit and Loss A/c 12000 (Debit balance – loss)

b) General Reserve A/c Dr 48,000

To M Capital A/c Dr – 16000

N Capital A/c Dr – 16000

O Capital A/c Dr – 16000

- List out the various adjustments required in the accounts of a firm on retirement of a partner. (6 Points)

- List out any 6 accounting treatments involved on the retirement or death of a partner. (3Marks)

Ans : Accounting Treatments on Retirement

1. Change in Profit sharing ratio.

2. Calculation of gaining ratio.

3. Adjustment regarding goodwill.

4. Adjustment of reserves and accumulated profits/losses.

5. Revaluation of assets and liabilities.

6. Ascertainment of profit or loss up to the date of retirement.

7. Calculation of total amount due to the retiring / deceased partner.

8. Settlement of total amount due to the retiring / deceased partner.

9. Adjustment of capitals of continuing partner

(Any six points – 1⁄2 scores for each point. Max. 3 scores)

- Ameena, Fidha and Gayathri are partners sharing profits and losses in the ratio of 5 : 3 : 2. Fidha retires from the firm and her share was acquired by Ameena and Gayathri in the ratio of 2 : 1. Calculate the new ratio. (3Marks)

Ans: Old Ratio of Ameena, Fidha and Gayathri = 5:3:2 4

Fidha retires and her share = 3/10

Fidha’s share acquired by Ameena and Gayathri in the ratio of 2:1

Fidha’s share acquired by Ameena = 3/10 X 2/3 =6/30

So Amena’s new share =5/10 + 6/30 (15/30+ 6/30)=21/30

Fidha’s share acquired by Gayathri = 3/10 X 1/3 = 3/30

So Gayathri’s new share = 2/10+3/30(6/30+3/30)=9/30

New ratio of Ameena and Gayathri = 21:9 or 7 : 3

( One score each for above calculation – Max. 4 scores)

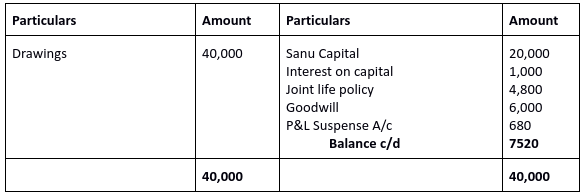

- Manu, Nithin and Sanu are partners in a firm, sharing profits in the ratio 3 : 1 : 1. Their capital was :

Manu – ` 40,000

Nithin – ` 20,000

Sanu – ` 20,000

The partnership deed provided that

(a) Interest on capital was provided at 10% per annum.

(b) A joint life policy was taken by partners for ` 24,000.

(c) The goodwill of the firm is valued at ` 30,000.

(d) Sanu’s drawings for the previous year were ` 40,000.

(e) The profit of the last 3 years ending 31st December were ` 8,000, ` 6,400 and 6,000.

(f) Profit till the date of death is calculated on the basis of last three years average profit.

Sanu died on July 1, 2016. Prepare an account showing the amount payable to the representatives of Sanu. (5 Score)

Ans :

Sanu’s Executors Loan Account

- Do you think that there is a need for the revaluation of assets and liabilities of a firm on the retirement of a partner ? Justify your answer. (2 score)

Ans : a) Yes

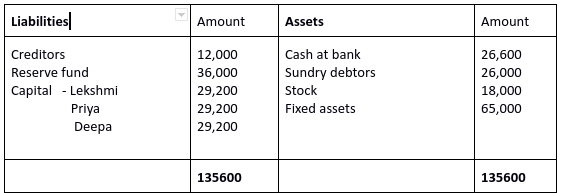

b) To find out the appropriate share of retiring partner in the firm. - Following is the Balance Sheet of Lekshmi, Priya and Deepa, who share profits and losses equally.

Lekshmi died on 31st May 2017. According to the Partnership deed her legal representatives are entitled to :

(1) Balance in the capital account and undistributed profit/loss.

(2) Share of Goodwill under average profit method.

(3) Share in the profit upto the date of death based on last year Profit.

(4) Interest on capital @ 6% p.a.

The goodwill of the firm under average profit method is ` 42,000, and profit for the year 2016-17 ` 21,600. Calculate the amount payable to Lekshmi’s legal representatives.

Ans : Calculation of Amount payable Lekshmi’s executors

Capital Account Balance – 29,200

Add : Share of reserve (36000*⅓) -12,000

Share of Goodwill (42000*⅓) -14000

Share of Profit (21600*2/12*⅓) – 1200

Interest on capital (29200*6/100*2/12) – 292

Amount payable to lakshmi’s executors – 56692

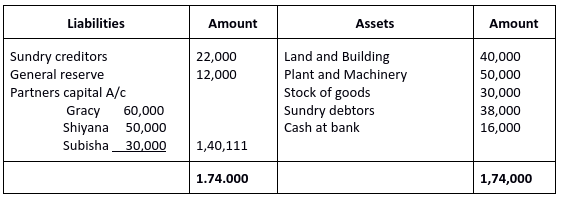

- Gracy, Shiyana and Subisha were partners in a firm sharing profits in the ratio of 5 : 3 : 2.

Their balance sheet as on 31-03-2017 stood as follows :

Balance Sheet as on 31-03-2017

Gracy died on 1-10-2017. Her legal heirs are to be settled on the following terms :

(a) Interest on capital to be provided @ 10% p.a.

(b) Profit till the date of death may be calculated on the basis of last year’s profit, which was 30,000.

Prepare the Capital Account of the deceased partner.

- On death of a partner, his legal representatives were settled by paying Rs.1,20,000′ As per the Capital Account. The amount due to him after all adjustments was Rs .1,05,000. Ascertain the deceased partner’s share of goodwill from the firm.

(Hint : Case of hidden goodwill)

- On retirement of a partner, the amount of General Reserve is transferred to all partner’s capital account in :

(a) New Profit Sharing Ratio (b) Capital Ratio (c) Old Profit Sharing Ratio (d) Gaining Ratio

- Anil, Biju and Chithra were partners sharing profit and losses in the ratio of 5 : 4 : 3. Biju retired from the firm. Gaining ratio of the remaining partners will be :

(a) 5 : 4 (b) 5 : 3 (c) 4 : 3 (d) Equal

- Anila, Kamla and Vimla are partners in a firm. Anila retired from the firm on 1st April, 2017. On that date ` 2,00,000 becomes due to her and the amount was transferred to her Loan Account. Remaining partners promised to pay the amount due to her in four equal annual installments together with interest @ 8% annum. Prepare Anila’s Loan Account till the loan closed.

(last year balance 54000) - The balance of the Revaluation account prepared at the time of retirement of a partner is transferred to _______.

(a) All partners’ capital accounts in old ratio. (b) Existing partners capital account in new ratio. (c) Old partners capital account in gaining ratio. (d) Existing partners capital account in capital ratio.

- Rekha, Remya and Resmi are partners in a firm. Remya retires from the firm and 36,000 becomes due to her. Rekha and Resmi promise to pay her the amount due in four equal installments at the end of every year with interest at 10% p.a. on outstanding balance. Prepare Remya’s Loan Account for 4 years.

( closing balance 9900) - Najeeba, Sherin and Nasar are equal partners. Nasar decides to retire. On the date of his retirement, the Balance Sheet of the firm showed a General Reserve of ` 40,000 and Profit and Loss Account ` 20,000 (Dr.)

Show the accounting treatment for the above.

- Sruthi, Aleena and Febina are partners in the ratio of 3 : 2 : 1. Sruthi retires and her share is acquired by the remaining partners in the ratio of 3 : 2. Calculate the new ratio.

Ans: 19:11 - Gracy, Shiyana and Subisha were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Their balance sheet as on 31-03-2017 stood as follows :

Gracy died on 1-10-2017. Her legal heirs are to be settled on the following terms :

(a) Interest on capital to be provided @ 10% p.a.

(b) Profit till the date of death may be calculated on the basis of last year’s profit, which was Rs. 30,000.

Prepare the Capital Account of the deceased partner.

(Ans :76500)

- Muneer, Madhav and Mathew are partners sharing profits in the ratio of 5:3:2. Muneer retires from the firm. Madhav and Mathew decided to share future profits in the ratio of 4:3. Calculate gaining ratio of continuing partners.

Ans:19:16 - Meera, Radha and Rajani are partners sharing profits and losses in the ratio of 4:3:2. Radha died on 30ft September, 2017. Calculate the share of profits payable to Radha from 1st April, 2017 upto her date of death on the basis of the average profits of the last 3 years.

Profits for the last 3 years are :

Year Profit (()

2014- 15 – 1,20,000

20t5- 16 – 80,000

2016- 17 – 70,000

Also, pass journal entry for the same.

(Ans :15000, P&L susp: A/c to Radha’s capital)

- Neeraj, Nima and Aswin are partners sharing profits in the ratio of 4:3:2′ Goodwill is appearing in the books at a value of Rs. 45,000. Nima retires. on retirement, goodwill of the firm is valued at Rs.90,000. Neeraj and Aswin decided to share future profits in the ratio of 3:2 and also not to show goodwill in the books. Give journal entries’

Ans: GR :7:8 - On death of a partner, his legal representatives were settled by paying Rs.1,20,000 As per his Capital Account. The amount due to him after all adjustments was

- Rs.1,05,000. Ascertain the deceased pariner’s share of goodwill from the firm.

(Hint : Case of hidden goodwiil)

- Arun, Hari and Jaya are partners in a firm sharing profits and losses in the ratio of 5 : 3 :2. Jaya retired from the firm and the continuing partners decided to share future profits in the ratio of 3 :2 respectively. On her retirement, the firm’s goodwill is valued at Rs.50.000.

Record necessary journal entries for the treatment of goodwill without opening the Goodwill Account.

(Ans: Arun-5000,Hari-5000 to Jaya -10000)

- Tiji, Jiji and Mini are partners sharing profits in the ratio of 3:2:1. Tiji retires from the firm and her share is taken up by Jiji and Mini in the ratio of 3:2. Calculate the new profit sharing ratio.

Ans:19:11 - Prakash, Rajesh and Sareesh are equal partners in a firm. Rajesh retires from the firm. On the date of retirement Rs.1,20.000 became due to him. Prakash and Sareesh promises to pay him in ‘4’ equal installments at the end of every year. plus accrued interest @ 12% p.a. on the unpaid balance.

(a) Pass journal entry for the amount due to Rajesli on the date of retirement.

(b) Prepare ‘Rajesh’s loan account’, till the amount is fully paid off.

- Priya,Priji and Viji are partners ,sharing profit and losses in the ratio of 4:3:2. Priji retired and goodwill is valued at Rs.63,000.Priya and Viji are decided to share future profits and losses in the ratio of 5:3.Record necessary journal entry,when goodwill is raised full value and written off immediately.

(Ans: Good will to all partners -63000, Priya-39375,viji-23625 to goodwill – 63000 - Renjith,Sumesh and Aneesh are partners in a firm.Sumesh retires from the firm.On the date of retirement of Sumesh Rs.45,000 become due tohim .Renjith and Aneesh promise to pay the amount in installments.Prepare Sumesh’s loan account ,when they agree to pay three yearly installments of Rs.15,000 including interest at 12% p.a. On the outstanding balance during the first three years and the balance including interest in fourth year.

- P,Q and R are partners in a firm.Q retires.On his date of retirement Rs.60,000 becomes due to him.P and R promise to pay him in installments every yearat the end of the year.Prepare Q’s Loan A/c. in the following cases”

A -When the payment is made four yearly installments plus interest @12% p.a. On the unpaid balance.

B – When they agree to pay three yearly installments of Rs.20,000including interest @12% p.a. On the outstanding balance during the first three years and the balance including interest in the fourth year.

- On retirement of a partner, the amount of General Reserve is transferred to all partner’s capital account in :

(a) New Profit Sharing Ratio (b) Capital Ratio

(c) Old Profit Sharing Ratio (d) Gaining Ratio - Rajesh, Sabu and Muneer were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Muneer retired from the firm and the new profit – sharing ratio after retirement is 3:2. The gaining ratio is :

(a) 3 : 2 (b) 2 : 1 (c) 1 : 1 (d) 2 : 3 - The balance of Revaluation account prepared at the time of retirement of a partne iis transferred to _______.

(a) All partners capital account in old ratio. (b) Existing partners capital account in new ratio. (c) Old partners capital account in gaining ratio. (d) Existing partners capital account in capital ratio.

- Rekha, Remya and Resmi are partners in a firm. Remya retires from the firm and ` 36,000 becomes due to her. Rekha and Resmi promise to pay her the amount due in four equal instalments at the end of every year with interest at 10% p.a. Out outstanding balance. Prepare Remya’s Loan Account for 4 years.