Ch.5 Dissolution of a Partnership Firm .

- Write down the journal entries for the following at the time of dissolution of a partnership firm. (2 Marks)

(a) For sale of assets

(b) For payment of realisation expenses

Ans :(a) Sale of Asset:

Cash / Bank Account Dr

To Realisation Account

b) Payment of realisations expenses:

Realisation Account Dr

To Cash / Bank Account

(One score each for correct entry)

- Profit on realization is credited to _______ account.

(a) Profit and Loss Account

(b) Partners’ Capital Account

(c) Revaluation Account

(d) Profit and Loss Appropriation Account

Ans: (b) Partners’ Capital Account - At the time of dissolution of a firm, which of the following liability will be paid first ?

(a) Outstanding Salary of partners

(b) Partners Loan

(c) Partners Capital

(d) Sundry Creditors

Ans : (d) Sundry Creditors

- Unrecorded assets when taken over by a partner are shown in ______.

(a) Debit side of Realization Account

(b) Credit side of Bank Account

(c) Debit side of Bank Account

(d) Credit side of Realization Account

Ans : (d) Credit side of Realization Account

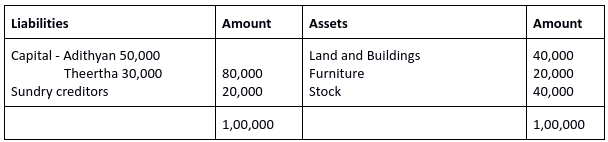

- Adithyan and Theertha are partners of Aswani Traders in the ratio of 2:3.Their Balance Sheet as on 31-12-2019 stood as follows

Balance sheet as on 31-12-2019

Prepare realisation account on the assumption that the firm is dissolved on the above date by considering the following:

A- Land and Building realised Rs.60,000

B- Furniture sold for Rs.20,000

C-Stock taken over by adithyan Rs.15,000

Ans : Realisation loss 5000 ( Adithyan – 2000, Theertha – 3000)

- Jose and Joy are partners in a firm. Due to heavy loss in business Joy demands to dissolve the firm. Mention any four ways of dissolution of a firm. (2 Marks)

Ans : Dissolution by agreement

Compulsory dissolution

On happening of certain contingencies

Dissolution by court

Dissolution by notice - A and B are partners in a firm. They decided to dissolve the firm on 31st December, 2018. Give journal entries for the following transactions on dissolution :

(a) Realisation expense of 1,500 paid by the firm.

(b) Furniture taken over by ‘A’ for ` 4,000.

(c) ‘B’ is ready to discharge the creditors ` 5,000.

Ans: a) Realisation A/c Dr 1500

To Cash / bank a/c 1500

b) A’s Capital A/c Dr 4000

To Realisation A/c 4000

c) Realisation A/c Dr 5000

To B’s Capital A/c 5000

- Sumith and Amith are partners, who were share profit in the ratio of 3 : 2. Following isthe Balance Sheet as on 31st March, 2018. (2020 Say)

Balance Sheet as on March 31.2018

The firm was dissolved on March 31, 2018. Prepare a realisation account with the following additional information :

(a) Stock realized at ` 1,000 less.

(b) Debtors realized at a discount of 10%.

(c) Fixed assets realized at ` 50,000.

(d) Realisation expense of ` 1,000 paid by Sumith.

Ans : Loss on realisation – 2850 ( Sumith – 1710, Amith – 1140)

- State any three differences between dissolution of partnership and dissolution of firm. (3 score)

- Ashina, a Commerce student is in a dilemma that she has no clear idea about the differences between dissolution of partnership and dissolution of firm. Can you help her by giving three points of difference in this regard ?

| Basis | Dissolution of partnership | Dissolution of Firm |

| 1-Termination of business | Business is not terminated | The business is terminated |

| 2-settlement of Assets and liabilities | Assets and liabilities re valued and new B/S prepared | Assets are sold,liabilities are paid off and balance utilised towards settlement of partners |

| 3-Court intervention | Court does not intervene.Dissolution of partnership by mutual agreement | A firm can be dissolved by the court order |

| 4-Economic relationship | Economic relationship still continues,but with some changes | Economic relationship among the partners comes to an end |

| 5-Closure of books | Books of accounts are not closed as the business is not terminated | All books of accounts are closed as business is terminated |

- Manu and Manoj are partners, who share profit in the ratio of 2 : 1. Following is the Balance Sheet as on 31st March 2018.

Balance Sheet of Manu and Manoj as on 31-3-2018

On a dispute between the partners they decided to dissolve the firm on the following terms :

(1) Realisation expenses amounted to ` 4,000.

(2) Debtors realised at a discount of 5%.

(3) Stock realised at ` 50,000.

(4) Fixed Assets realised –

Land & Building ` 1,40,000

Furniture ` 18,000

(5) There was an unrecorded assets of ` 5,000, which was taken over by Manu.

(6) Creditors are paid in full.

Prepare necessary ledger accounts to close the books of firm .

Ans : Realisation Profit – 25100(Manu – 16733,Manoj – 8367)

(Capital Account Balance -Manu – 171733, Manoj – 98367)

- Which among the following account is prepared at the time of dissolution of a partnership firm ?

(a) Profit and Loss Appropriation Account

(b) Profit and Loss Adjustment Account

(c) Revaluation Account

(d) Realisation Account

- The business of the firm is terminated when _________ take place.

(a) Dissolution of Partnership

(b) Retirement of a partner

(c) Death of a partner

(d) Dissolution of firm

- Select the suitable Account from brackets for the following :

(Realisation, Bank, Partners, Capital)

- (a) On dissolution of the firm, capital accounts of partners are closed by transferring the capital balance to _______ Account

(b) The accumulated loss appearing in the balance sheet is closed by transferring to _______ Account. - Write any three differences between dissolution of partnership and dissolution of firm. Which of the following is prepared at the time of dissolution of a Partnership firm ?

(a) Revaluation Account (b) Balance Sheet (c) Profit and Loss Account (d) Realisation Account - Briefly explain the “treatment of losses” in the settlement of accounts on dissolution of a firm.

Ans:First out of profits

Next out of capital of partners

Last,if necessary by the partners individually in their profit sharing ratio.

- 16. Complete the journal entries passed at the time of dissolution of a partnership firm.

(a) Partner’s Capital A/c Dr.

To ……………….

(Asset taken over by a partner)

(b) …………………A/c Dr.

To Realisation A/c

(Sale of assets)(c) …………………A/c Dr.

To Bank A/c

(Payment of Realisation expenses)

Ans : a ) Realisation A/s

b) Bank A/c

c) Realisation A/c