Download GNUKhata Software : Click here

Download link 2: Click here

Download For Linux 20.04 : Click here

For GNUKhata Presentation Click here

Click ” Slide show” for opening Presentation in bowser

How to Install GNUKhata Software

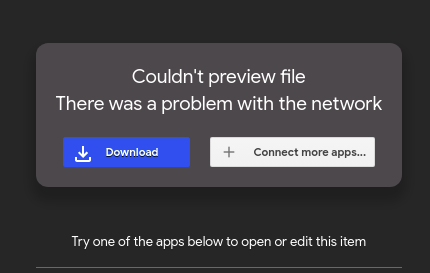

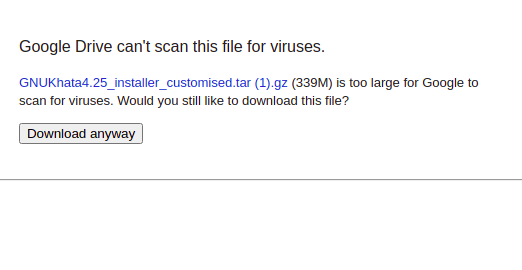

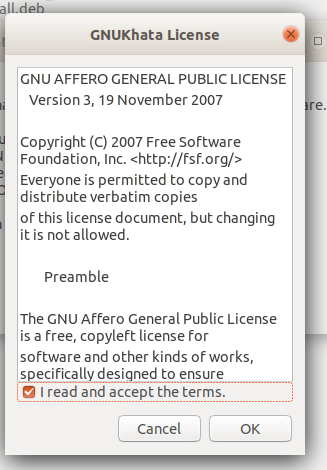

Click the above link ,Download the software

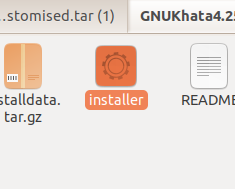

Open the Extracted folder and

How to Uninstall other version of GNUkhata

GNUKhata Uninstaller : Click here

Download the “Uninstaller ” from above link

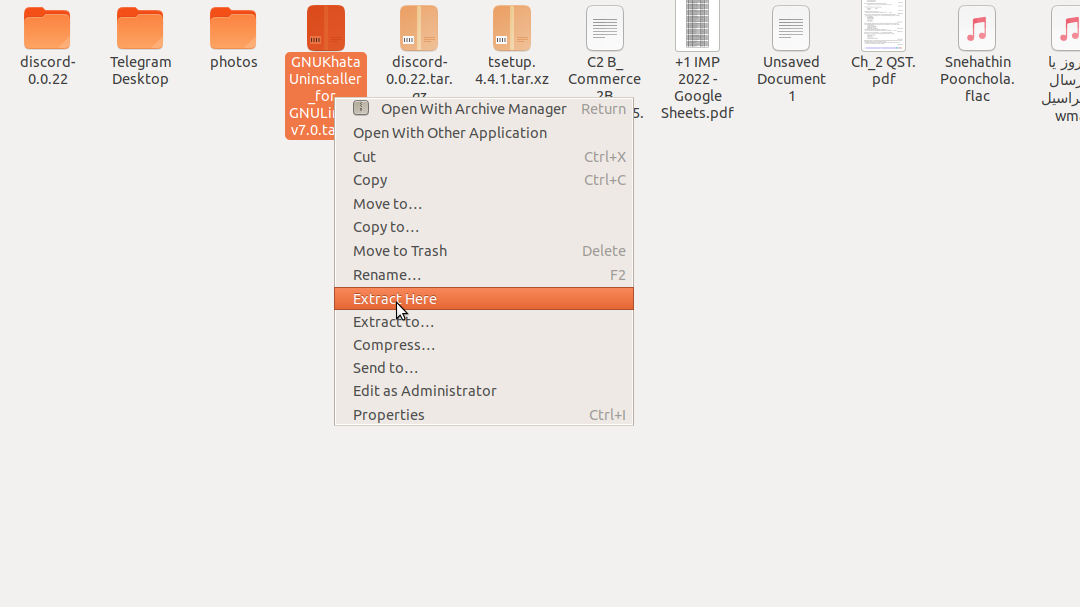

“Extract” thedownloaded file by right click

Enter System password and wait for few minutes

After uninstall , install new version of GNUKhata from the above link

Download PDF File :Click here

FUNDAMENTALS OF COMPUTERISED ACCOUNTING

Maintenance of accounting records with help of accounting software is known as computerised accounting. Ex: Tally.GNUKhata,Daceasy,Peachtree,Sap etc.

ADVANTAGES OF COMPUTERISED ACCOUNTING SYSTEM

a. Transactions are posted instantly to various accounts on voucher entry. b. Automatic balancing of accounts

c. Easy alteration

d. Storage and retrieval of large volume of data

e. Reports can be prepared as user requirement

f. Accurate and speedy processing of data

Difference between Manual accounting and computerised accounting

| Manual Accounting | Computerised Accounting |

| 1-Manually performing accounting works | 1-Works done with the help of computer and software. |

| 2-Automatic processing of accounts is not possible | 2- Automatic processing is possible |

| 3-Periodic reports are difficult to generate | 3-Can easily generate periodic reports |

| 4- Time consuming | 4 – Speedy |

Features of Accounting Software

- It is designed to automate and integrate all business operations like journalising,posting,ledger balancing and preparation of final accounts.

- Inventory management is possible.

- Can easily prepare payroll

- Preparation of report for managerial decision making is possible.

- Timely generation of reports in desired format.

GNUkhata

GNUkhata a free and open source software for accounting and inventory management being developed by Digital Freedom Foundation funded by International Centre for Free and Open Source Software(ICFOSS).

Features of GNUKhata

- It is a free and open source accounting software.

- Based on double entry system of accounting

- Drill down facility is used for preparing reports.

- Financial reports like trial balance,trading and Profit and loss account ,balance sheet etc can be prepared.

- Password security and data audit facility provided.

- Documents can be attached in vouchers.

- Source document can be attached along with the voucher entry.

- Export import of data is possible in spreadsheet.

Starting GNUKhata

Application—->Office—–> GNUKhata

Create Organisation: The first step in operating GNUKhata is to create an organisation.It may be either profit or non-profit organisation.

- Click on “Create Organisation” tab and

- enter “Organisation Name “ “Zion chemicals”

Case : As Is

Organisation Type : Profit Making

Financial year :01-01-2016 to 31-12-2016

Select “ Accounts only” and click “Proceed” button

- Create Admin – As part of providing security to the accounting information we have to setup the administrative features.It is mandatory to create ‘Admin’.Enter User name ,Password,security question for resetting password and answer for security question (Enter zion in all fields) and click on “ Create & Login”.

Methods of maintaining Accounts

Accounts only: Select this option if financial accounts only are to be maintained

Accounts with inventory:-Select this option if both financial accounts and inventory are required.

Security Features

1-Password: can restrict access to company’s data to authorised users using password.

2-Data audit: This feature is available to administrator to track any unauthorised changes have taken place in the data.

3-Data vault:- This feature is encrypting data for additional security.

Accounts Group

Bringing together accounts of similar nature at one place is known as grouping of accounts.Grouping determines whether a ledger goes to P&L A/c or Balance sheet. GNUKhata has 13 pre defined accounting groups,of which 9 relates to the balance sheet and 4 to P&L A/c or income & Expenditure Account.

Profit and Loss Or Income and Expenditure Account Groups

| SI.No: | Group Name | Sub-Group name |

| 1 | Direct income | None |

| 2 | Direct expenses | None |

| 3 | Indirect income | None |

| 4 | Indirect Expenses | None |

Balance Sheet Groups

| SI.No: | Group Name | Sub-Group name |

| 1 | Fixed Assets | Building,Furniture,land,Plant & Machinery |

| 2 | Investments | Investment in bank Fixed Deposits,Investment in shares & Debentures |

| 3 | Loans(Assets) | None |

| 4 | Current Assets | Bank,Cash,Inventory,Loans & Advances,Sundry Debtors |

| 5 | Miscellaneous Expenses (Assets) | None |

| 6 | Capital / Corps | None |

| 7 | Loans (Liability) | Secured,unsecured |

| 8 | Reserves | None |

| 9 | Current Liability | Provisions,Sundry creditors for expenses,Sundry creditors for purchases |

Ledger

Ledger accounts is a formal record of transactions affecting a particular item. In GNUKhata an account itself is called ledger.

To create a Ledger Account ,select ‘Create Account’ option from ‘Master’ menu.

Only accounts of assets and liabilities have opening balances.income and expenses are closed by transferring to Trading and Profit & Loss Account.

System Generated Ledger Accounts

When an organisation is created the software automatically creates the following ledgers.these accounts can neither be modified nor deleted.

| SI.No: | Account Name | Group Name | Sub-Group Name |

| 1 | Closing stock | Current Assets | Inventory |

| 2 | Opening Stock | Direct Expenses | None |

| 3 | Profit & Loss AccountOr Income & Expenditure A/c | Direct Income | None |

| 4 | Stock at the Beginning | Current Assets | Inventory |

Voucher Entry Transactions are recorded through voucher entry.A voucher contains all the details of a particular transaction.

Pre-defined Accounting Voucher types

Each voucher entry should be passed through appropriate voucher types. They are

- Contra (F8)- Contra voucher is used to record transactions involving bank and cash accounts or between two bank accounts or two cash accounts.

- Payments(F5):-Used to record allpayments.(cash/bank)

- Receipt(F4):- Used to record receipt of cah (cash/bank)

- Journal(F9):- Used to record adjusting and closing entries, purchase and sale of fixed asset on credit etc.usually it is used as a non cash voucher.

- Sales(F6) :-Used to record sale of goods( cash and credit)

- Purchase(F7) :– used to record all purchase of goods( cash and credit)

- Debit note(CTRL+4): Used to record purchase return or discount rebate received

- Credit note(CTRL+3) :-used to record sales return or discount or rebate allowed.

Accounting Reports

Cash book: Cash book records all receipt and payment of cash.

Bank Accounts: Banking transactions of the business can be recorded in ledger accounts placed under the group bank accounts.

Bank reconciliation statement: A bank reconciliation statement is a statement prepared by the depositor to reconcile(agree)the balance as per pass book with that of bank account.

Trial Balance :Trial balance is a statement of total or balances of various ledger accounts.

Profit and Loss Account : Profit & Loss account displays the profit or loss of the business.

Balance sheet : It displays the position of assets and liabilities of the business on a particular date.

Treatment of Specific Items

Closing Stock:-Goods lying unsold with the business at the end of the accounting are termed as closing stock.It is current asset and included in the asset side of B/S. At the same time it will appear in the credit side of P&L A/c.

Opening Stock:-The stock of goods available at the beginning of current financial year is termed as opening stock.It is treated as Direct expenses and appears in the debit side of P&L A/c.

Stock at the Beginning:-If the accounts of business are computerised for the first time,the amount of opening stock can be inserted through the following steps:

Step 1 – Edit the Stock at the beginning Account

Master – -> Edit Accounts–>Select ‘Stock at the beginning Account’-> Click on Edit->Enter

the Opening Balance

Step 2- Voucher->select Journal Voucher-> Enter Voucher No.& Opening date -> Debit Opening

stock and credit stock at the beginning.

Company creation in GNUKHata : Click here

Ledger Creation : Click here

Practical video lessons : http://www.comlive.in/cas