7.1 INTRODUCTION

Modern day business requires large amount of money. Also, due to increasing competition and fast changing technological environment, the element of risk is increasing. As a result, the company form of organisation is being preferred by more and more business firms, particularly for setting up medium and large sized organisations.

FORMATION OF A COMPANY

Formation of a company is a complex activity involving completion of legal formalities and procedures. To fully understand the process one can divide the formalities into three distinct stages, which are:

(i) Promotion;

(ii) Incorporation and

(iii) Subscription of capital.

(i)Promotion of a Company

Promotion is the first stage in the formation of a company. It involves conceiving a business idea and taking an initiative to form a company.

The difficult task of promoting a company is usually undertaken by a person called Promoter

Promoter: – The one who undertakes the promotion work is called promoter. Promoter is a person who undertakes to form a new company and carries out all the preliminary work in connection with its establishment as a going concern. The promoter can be a person, a firm, an association or even a company.

Functions of a Promoter /Steps in promotion

The important functions of promoters may be listed as below:

( i) Identification of business opportunity:

:The first and foremost activity of a promoter is to identify a business opportunity. The opportunity may be in respect of producing a new product or service or making some product available through a different channel or any other opportunity having an investment potential.

(ii) Feasibility studies: It may not be feasible or profitable to convert all identified business opportunities into real projects. The promoters, therefore, undertake detailed feasibility studies to investigate all aspects of the business they intend to start.

- Technical feasibility: Sometimes an idea may be good but technically not possible to execute. It may be so because the required raw material or technology is not easily available.

- Financial feasibility: Every business activity requires funds. The idea may be good but the fund required for it is not possible to raise. The promoters have to estimate the fund requirements for the identified business opportunity.

- Economic feasibility: Sometimes it so happens that a project is technically viable and financially feasible but the chance of it being profitable is very little. The promoters must have consider and study the profitability of the project

(iii) Name Approval

Having decided to launch a company, the promoters have to select a name for it and it should be ensure that the name is not undesirable to the Registrar of Companies.

(iv)Fixing up Signatories to the Memorandum of Association:

Promoters have to decide about the members who will be signing the Memorandum of Association of the proposed company. Usually the people signing memorandum are also the first Directors of the Company. Their written consent to act as Directors and to take up the qualification shares in the company is necessary.

(iv)Appointment of professionals:

Certain professionals such as mercantile bankers, auditors etc., are appointed by the promoters to assist them in the preparation of necessary documents which are required to be file with the Registrar of Companies

(vi) Preparation of necessary documents: The promoter takes up steps to prepare certain legal documents, which have to be submitted under the law, to the Registrar of the Companies for getting the company registered. These documents are Memorandum of Association, Articles of Association and Consent of Directors.

Documents Required to be Submitted

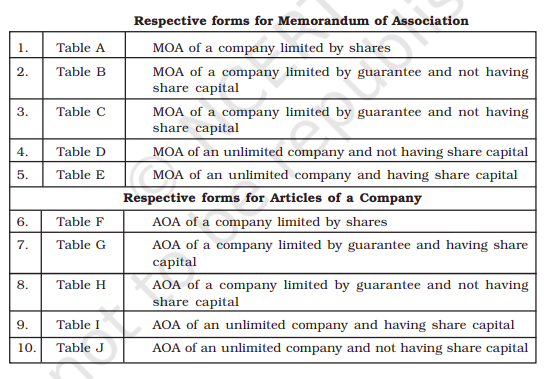

A. Memorandum of Association:

Memorandum of Association is the most important document as it defines the objectives of the company. No company can legally undertake activities that are not contained in its Memorandum of Association. As per section 2(56) of The Companies Act, 2013 The Memorandum of Association contains different clauses, which are given as follows:

(i) The name clause: This clause contains the name of the company with which the company will be known, which has already been approved by the Registrar of Companies.

(ii) Registered office clause: This clause contains the name of the state, in which the registered office of the company is proposed to be situated. The exact address of the registered office is not required at this stage but the same must be notified to the Registrar within thirty days of the incorporation of the company.

(iii ) Objects clause: This is probably the most important clause of the memorandum. It defines the purpose for which the company is formed. A company is not legally entitled to undertake an activity, which is beyond the objects stated in this clause.

(iv) Liability clause: This clause limits the liability of the members to the amount unpaid on the shares owned by them. For example, if a shareholder has purchased 1000 shares of Rs.10 each and has already paid Rs. 6 per share, his/her liability is limited to Rs. 4 per share. Thus, even in the worst case, he/she may be called upon to pay Rs. 4, 000 only.

(v) Capital clause: This clause specifies the maximum capital which the company will be authorised to raise through the issue of shares. The authorised share capital of the proposed company along with its division into the number of shares having a fixed face value is specified in this clause.

The Memorandum of Association must be signed by at least seven persons in case of a public company and by two persons in case of a private company.

B. Articles of Association:

Articles of Association are the rules regarding internal management of a company. These rules are subsidiary to the Memorandum of Association and hence, should not contradict or exceed anything stated in the Memorandum of Association.

The Articles generally contains the following matters:

1. Exclusion wholly or in part of Table F.

2. Number and value of shares.

3. Issue of preference shares.

4. Allotment of shares.

5. Calls on shares.

6. Transfer and transmission of shares.

7. Nomination.

8. Forfeiture of shares.

9. Alteration of capital.

10. Buy back.

11. Share certificates.

12. Voting rights and proxies.

13. Meetings and rules regarding committees. 18. Directors, their appointment and delegations of powers.

14. Issue of Debentures and stocks.

15. Audit committee.

16. Managing director, Whole-time director, Manager, Secretary.

17. Seal.

18. Remuneration of directors.

19. General meetings.

20. Directors meetings.

21. Borrowing powers.

22. Dividends and reserves.

23. Accounts and audit.

24. Winding up.

Table F

It is the model set of Articles of Association given in the Companies Act. It is applicable for Private Ltd and Public Ltd Companies

If a company adopts Table F, it need not prepare its own Articles of association

C. Consent of Proposed Directors:

Apart from the Memorandum and Articles of Association, a written consent of each person named as a director is required confirming that they agree to act in that capacity and undertake to buy and pay for qualification shares, as mentioned in the Articles of Association.

D. Agreement:

The agreement, if any, which the company proposes to enter with any individual for appointment as its Managing Director or a whole time Director or Manager is another document which is required to be submitted to the Registrar for getting the company registered under the Act.

E. Statutory Declaration:

A declaration stating that all the legal requirements pertaining to registration have been complied with is to be submitted to the Registrar with the above mentioned documents for getting the company registered under the law. This statement can be signed by an advocate or by a Chartered Accountant or a Cost Accountant or a Company Secretary in practice who is engaged in the formation of a company and by a person named in the articles as a director or manager or secretary of the company.

F. Receipt of Payment of fee:

Along with the above-mentioned documents, necessary fees has to be paid for the registration of the company. The amount of such fees shall depend on the authorised share capital of the company.

Position of Promoters:-

Promoters undertake various activities to get a company registered and get it to the position of commencement of business. But they are neither the agents nor the trustees of the company. They can’t be the agents as the company is yet to be incorporated. Therefore, they are personally liable for all the contracts which are entered by them. Promoters of a company enjoy a fiduciary position with the company, which they must not misuse. They can make a profit only if it is disclosed but must not make any secret profits. Promoters are not legally entitled to claim the expenses incurred in the promotion of the company. However, the company may choose to reimburse them for the pre-incorporation expenses. The company may also remunerate the promoters for their efforts by paying a lump sum amount or the company may also allot shares or debentures at free of cost or give them an option to purchase the securities at a future date.

(ii)Incorporation or Registration:-

After completing the aforesaid formalities, promoters make an application for the incorporation of the company. incorporation is a legal process consisting of the following steps:

i) Application for the approval of name

ii) Filing of documents: The next step is to file the following documents with the registrar of the companies.

a) memorandum of association

b) Articles of association

c) notice d) agreements

e) list of proposed directors f) written consent

g) an undertaking

h) a copy of licence

i) statutory declaration

iii) certificate of incorporation: If the registar is satisfied that all requirement regarding registration have been duly complied with , he will enter the name of the company in the registar maintained by him .Then he will issue a certificate called certificate of incorporation which is dated and signed by him.The certificate of incorporation is a conclusive proof that the company is duly registered. a private company can commence business immediately after incorporation.

On the issue of Certificate of Incorporation, a private company can immediately commence its business. It can raise necessary funds from friends, relatives or through private arrangement and proceed to start business.

(iii) Capital Subscription

A public company can raise the required funds from the public by means of issue of securities (shares and debentures etc.). For doing the same, it has to issue a prospectus which is an invitation to the public to subscribe to the capital of the company and undergo various other formalities. The following steps are required for raising funds from the public:

(i)- SEBI Approval:

SEBI (Securities and Exchange Board of India) which is the regulatory authority in our country for regulating Capital Market. Prior approval from SEBI ,required before going ahead with raising funds from public.

(ii) Filing of Prospectus:

A copy of the prospectus or statement in lieu of prospectus is filed with the Registrar of Companies.it is an invitation to the public to apply for securities (shares, debentures etc.) It contains all relevent infromation about the company.

(iii)Appointment of Bankers, Brokers and Underwriters:

The application money is to be received by the bankers of the company. The brokers try to sell the shares by distributing the forms and encouraging the public to apply for the shares. Underwriters undertake to buy the shares if these are not subscribed by the public. They receive a commission for underwriting the issue.

(iv) Minimum Subscription:

In order to prevent companies from commencing business with inadequate resources, it has been provided that the company must receive applications for a certain minimum number of shares before going ahead with the allotment of shares. According to the Companies Act, this is called the ‘minimum subscription’.

(v) Application to Stock Exchange:

An application is made to at least one stock exchange for permission to deal in its shares or debentures.

(vi) Allotment of Shares:

If all formalities concerned are completed company allot shares to the applicants.

Commencement of Business:-

A private company can commence its business from the date of incorporation. But a public company has to obtain another certificate called Certificate of Commencement of Business from Registrar to starts its business. The Registrar will issue this Certificate with the following conditions; –

1. A copy of Prospectus/Statement in lieu of prospectus

2. Return of Allotment

3. Declaration with regard to the receipt of amount towards qualification shares

4. Declaration that no money is payable to the applicants (shares)

5. Declaration regarding Minimum subscription

6. Declaration on compliance of formalities

The Registrar shall examine these documents. If these are found satisfactory, a ‘Certificate ofCommencement of Business’ will be issued. This certificate is conclusive evidence that the company is entitled to do business. With the grant of this certificate the formation of a public company is complete and the company can legally start doing business.

One Person Company

With the implementation of The Companies Act, 2013, a single person could constitute a company, under the One Person Company (OPC) concept.One Person Company is a company with only one person as a member. That one person will be the shareholder of the company. It avails all the benefits of a private limited company such as separate legal entity, protecting personal assets from business liability and perpetual succession.

Director Identification Number (DIN)

Every Individual intending to be appointed as director of a company shall make an application for allotment of Director Identification Number (DIN) to the Central Government in prescribed form along with fees.

TYPES OF CONTRACTS

- Preliminary contract : A contract made before the registration of the company

- Provisional Contract : A contract made after Incorporation/Registration, but before the commencement of the business

Prospectus

It is the document issued by Public Ltd Companies inviting the public to subscribe for shares or debentures of the company

It is also called Offer Letter

Statement in lieu of Prospectus

It is the document issued by Public Ltd Companies instead of issuing Prospectus

Generally it is issued when the Public company prefer to collect finance from private sources