Download Text PDF File : Click here

Partnership

The relationship between persons who have agreed to share the profit of a business carried on by all or any of them acting for all.

To watch video Click here

General Features

1-Number of persons- In order to form partnership, there should be at least two persons coming together for a common goal and Maximum number of person is – 100

2-Agreement/deed – Partnership is the result of an agreement between two or more persons to do business and share its profits and losses. it may be written or oral

3- Business: The agreement should be to carry on some business. Mere co- ownership of a property does not amount to partnership

4 – Mutual Agency: A partner can bind other partners by his acts and also is bound by the acts of other partners with regard to business of the firm.

5 – Sharing of Profit: Another important element of partnership is that, the agreement between partners must be sharing of profits among the partners either equally or on the agreed ratio. If there is loss the same treatment should be made as in the case of profit.

6 – The liability of a partner for acts of the firm is unlimited

7- Utmost good faith.

8- No separate legal existence

Partnership deed

It is a written document containing the terms of partnership as agreed by the partners.

Contents of Partnership deed

- Name of the firm

- Name and address of partners

- Nature & place of business

- Date of commencement of business

- Duration if any

- Division of profit or loss

- Interest on capital or drawings

- Interest on partners loan

- Salaries,commission etc

Provisions of Partnership Act Relevant for Accounting

Rules applicable in the absence of partnership deed

1. Profit sharing ratio – The profits and losses of the firm are to be shared equally by partners irrespective of their capital contribution.

2. Interest on capital – No partner is entitled to claim any interest on the amount of capital. If the deed provides for it should be paid only out of profit and if there is loss, no interest can be allowed.

3. Interest on drawings – No interest is to be charged on the drawings made by the partners.

4. Remuneration to partners – No partner is entitled to get salary or other remuneration for taking part in the conduct of the business

5. Interest on loan – : If any partner has advanced loan to the firm for the purpose of business, he/she shall be entitled to get an interest t at the rate of 6%per annum. It should be paid even if there is loss.

To watch video click here

Capital Accounts of Partners

All transactions relating to partners of the firm are recorded in the books of the firm through their capital accounts. This includes the amount of money brought in as capital, withdrawal of capital, share of profit, interest on capital, interest on drawings, partner’s salary, commission to partners, etc,

Each partner’s capital account is prepared separately.

Methods of maintaining Partner’s capital accounts:

- Fixed capital method and

- Fluctuating capital method

A – Fixed capital Method

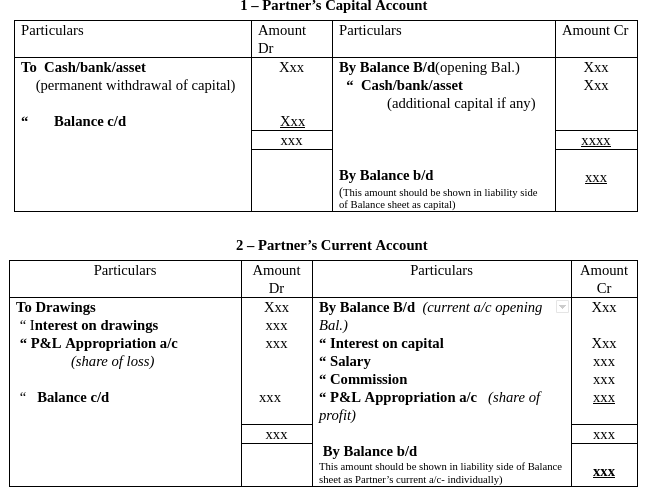

Under this method , the original capital invested by partners remains fixed unless some additional capital is introduced or capital withdrawn.Hence all items other than capital are not to be shown in capital account.For all those items are shown in a separate “Current account”. Thus each partner will have two accounts,

- Capital account

- Current account ( all adjustments are shown in Partners current a/c

Proforma –Under Fixed capital Method

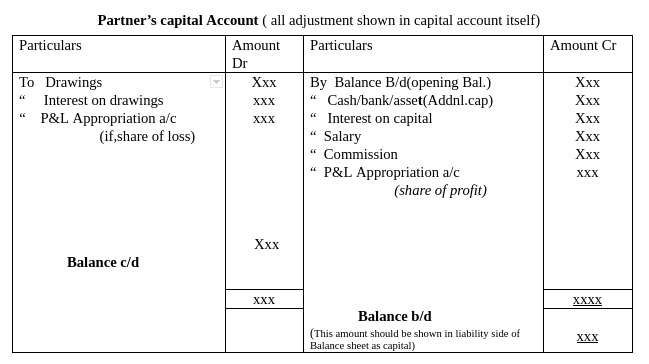

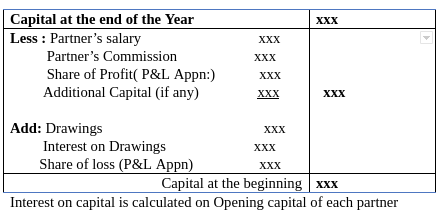

B – Fluctuating capital Method

Under Fluctuating capital method ,only one account – Capital Account for each partner is maintained.Adjustment in respect of additional capital, drawings, interest on capital,salary, commission, share of profit or loss are made directly in capital account.since the capital balance of partners fluctuating year to year.

| Fixed capital Method | Fluctuating Capital method |

| Capital A/c + Current A/c = | Capital A/c |

Questions

Q1 – Anand and Balan entered into a partnership contributing Rs.50,000 and Rs.30,000 respectively.They decided to share profits and losses in the ratio of 2:1. Anand was entitled to a salary of Rs.5000 p.a. Interest on capital was to be provided @6% p.a. The drawings of Anand and Balan for the year ending Dec.31,2015 were Rs.6,000 and Rs.5,000 respectively. Interest on drawings , Anand Rs.300 and Balan Rs.200 to be charged.The profit of the firm after providing for Anand’s salary and Interest on capital and taking into account interest on drawings were Rs.15,000.

Prepare the capital accounts of partners assuming that they maintaining the accounts according to

a) Fixed capital methods

b) Fluctuating capital method

Ans : a) Capital A/c balances – Anand – 50,000, Balan – 30.000. Current A/c Anand – 11,700, Balan – 1,600

b) Capital A/c – Anand – 61,700 , Balan – 31,600

Q2 – Ajith and Sajith entered in to a partnership agreement on 1st April 2010 with capital contribution of Rs.20,000 and Rs.40,000 respectively.They agreed up on the following terms and conditions.

- Profits and losses to be shared equally

- Interest on capital @12%

- Annual salary to Ajith Rs.6,000

- Commission to sajith @ Rs.400 per month

- Interest on drawings @9% p.a

Ajith withdraw Rs.4000 on October 1,2010 and Sajith Rs.8000 on July 1,2010. Sajith has given a loan of Rs.12,000 on January 1.2011 to the firm.The profit of the firm after making all adjustments was Rs.16,000.

Prepare Capital Accounts of partners as on March 31, 2011 according to

a) Fixed capital method

b) Fluctuating capital Method.

Ans : a) Capital A/c – Ajith – 20,000, Sajith – 40,000, Current Accounts Ajith – 12,220, Sajith- 9240

b) Capital A/c s – Ajith

Note : If nothing has been mentioned about the rate of interest on loan given by partner interest @6% should be given to the partner who has advanced loan over and above capital contribution.

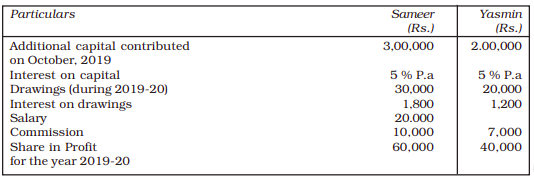

Q3 – Sameer and Yasmin are partners with capitals of Rs.15,00,000 and Rs. 10,00,000 respectively. They agreed to share profits in the ratio of 3:2. Show how the following transactions will be recorded in the capital accounts of the partners in case: (i) the capitals are fixed, and (ii) the capitals are fluctuating. The books are closed on March 31, every year.

Prepare Capital Accounts of Partners as

a)Fixed capital method and

b)Fluctuating capital method.

Ans : a) Capital Accounts – Sameer – 18,00,000, yasmin – 12,00,000. Current A/cs Sameer – 1,40,700 , Yasmin – 80,800

b) Capital A/c Sameer – 19,40,700, Yasmin – 12,80,800

Q4 – Anil and Sunil commenced business as partners on 1st April 2008. Anil contributed Rs.1,25,000 and Sunil contributed Rs.75,000 as their share of capital.The partners decided to share profit and losses in the ratio of 2:1. Anil was entitled a salary of Rs.1500 per month. Interest on capital was to be provided @6% p.a. The drawings of Anil and Sunil for the year ending 31 st march 2009 were Rs.12,000 and 24,000 respectively.The profit of the firm after providing for Anil’s salary and Interest on capital were Rs.36,000.

Draw up the capital accounts of the partners when:

A – Capital are fluctuating

B – Capital are fixed.

(Ans: Fluctuating Anil:1,62,500.Sunil 67,500.Fixed : Anil’s capital – 1,25,000, Sunil’s Capital:75,000. Current A/c 67,500, 75,000 (Dr).

Distribution of profit/loss among partners

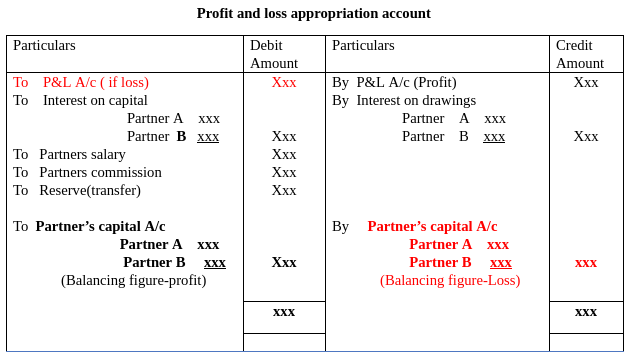

Profit and loss appropriation account

This is an extension of profit and loss account to record partner’s adjustment items and is prepared to show how net profit has been distributed among the partners

To watch video Click here

Journal Entries

1 – Transfer of the balance of P&L A/c to P&L Appropriation A/c

- If Profit

P&L A/c Dr

To P&L Appropriation A/c

- If Loss

P&L Appropriation A/c

To P&L A/c

2 – Interest on Capital

- For crediting Interest on capital to Partners’ capital Account

Interest on Capital Account A/c Dr

To Partner’s Capital/Current A/c (Individually)

- For transferring balance of interest on Capital to P&L Appropriation A/c

P&L Appropriation A/c

To Interest on capital A/c

3 – Interest on Drawings

- For charging Interest on Drawings to partner’s capital A/c

Partner’s Capital/Current A/c (Individually)

To Interest on Drawings A/c

- For transferring balance of Interest on drawings a/c to P&L Appropriation A/c

Interest on Drawings A/c Dr

To P&L Appropriation A/c

4 – Partners’ Salary/Commission

- For crediting Salary/Commission to Partners’ capital Account

Salary/Commission to Partner A/c Dr

To Partner’s Capital/Current A/c (Individually)

- For transferring balance Salary/Commission a/c to P&L Appropriation A/c

P&L Appropriation A/c

To Salary/Commission to Partner A/c

5 – Transfer of the balance of P&L Appropriation A/c to Partners’ Capital A/c

- If Profit

P&L Appropriation A/c Dr

To Partner’s Capital/Current A/c (Individually) A/c

- If Loss

Partner’s Capital/Current A/c (Individually) A/c Dr

To P&L Appropriation A/c

Questions

Q5 – Amit, Babu and Charu set up a partnership firm on April 1, 2019. They contributed Rs. 50,000, Rs. 40,000 and Rs. 30,000, respectively as their capitals and agreed to share profits and losses in the ratio of 3 : 2 :1. Amit is to be paid a salary of Rs. 1,000 per month and Babu, a Commission of Rs. 5,000. It is also provided that interest to be allowed on capital at 6% p.a. The drawings for the year were Amit Rs. 6,000, Babu Rs. 4,000 and Charu Rs. 2,000. Interest on drawings of Rs. 270 was charged on Amit’s drawings, Rs. 180 on Babu’s drawings and Rs. 90, on Charu’s drawings. The net profit as per Profit and Loss Account for the year ending March 31, 2020 was Rs. 35,660. Prepare the Profit and Loss Appropriation Account to show the distribution of profit among the partners.

Ans :Share of profit transferred to Capital accounts -Amit 6,000 Babu 4,000, Charu 2,000

Q6 – On 1st January 2009 Anand ,Balan and Chandran entered into partnership contributing Rs.60,000, Rs.40,000 and Rs.20,000 respectively and sharing profits and losses in the ratio of 5:3:2. Balan is entitled to a salary of Rs.5,000 and Chandran a commission of Rs.4,000 per year.Interest on capital is to be allowed at 5% per annum.During the year Anand withdrew Rs.10,000 , Balan Rs.6,000 and Chandran Rs.5,000. Interest on drawings was charged Rs.250 on Anand’s drawings Rs.150 on Balan’s drawings and Rs.200 on Chandran’s drawings.Profit in 2009 before the above mentioned adjustments was Rs.50,000.

You are required to pass the necessary journal entries relating to appropriation of profit and prepare the Profit and loss Appropriation Account and the partners Capital Accounts.

Q 7 – Rajan and Sajan are partners in a firm sharing profits and losses in the ratio of 2 : 1. Their capital balance as on 01-04-2022 was ` 4,00,000 and ` 3,00,000 respectively. The partnership deed provides that Rajan is to be paid a salary of ` 2,000 per month and Sajan is to get a commission of ` 10,000 for the year. Interest on capital is to be allowed at 8% p.a.

The drawings of Rajan and Sajan for the year were ` 30,000 and ` 10,000 respectively. Interest on Rajan’s drawings was ` 750 and on Sajan’s drawings, ` 250. The Net Profit of the firm before making these adjustments was ` 1,82,000.

Prepare Profit and Loss Appropriation Account. (Mar.23 5 Score)

Ans : Raj an – 62,000,Sajan – 31,000 (Balance – 93,000)

Q8 – On 1st january 2012 Manoj and Mukesh started a partnership business contributing Rs.25,000 and Rs.15,000 respectively towards capital and agreeing to share profits and losses in the ratio of 3:2. Asper the agreement , partners are entitled to interest on capital @10% per annum and Mukesh is entitled to a monthly salary of Rs.200

During the year 2012 Manoj and Mukesh withdrew Rs.4,000 and 2,000 respectively.The interest on drawings worked out to be ,Manoj Rs.150 and Mukesh Rs.100. On 31 st December 2012 their profit and loss account showed a credit balance of Rs.12,500 before making the above mentioned adjustments.

Give necessary journal entries and prepare profit and Loss Appropriation Account and the Partner’s Capital Accounts for the year 2012 .

Ans : Manoj – 27,160, Mukesh -19,340.

Partner’s Drawing A/c

Withdrawal by a partner in the form of money or money’s worth from a firm in anticipation of profit is called Drawings.It is a personal account.

Journal entry

Partner’s Drawings A/c Dr

To cash/Purchase A/c

At the end of accounting period,drawing account is closed by transfer to Partner’s Capital/Current A/c.

Partner’s Capital/Current A/c Dr

To Partner’s Drawing A/c

Note:If some amount is withdrawn from capital,it is recorded in capital A/c,not in Drawings A/c

Partner’s capital A/c Dr

To Cash/Bank A/c

Interest on capital

The Interest on capital is paid to the partners as a compensation for their capital contribution to the firm.If they invested this amount out side the business ,it would have a normal rate of interest and if some partners contributed more amount disproportionate to their profit sharing rights , they will be at an advantageous position.

- Interest on capital is a an expense for the firm and gain for partners individually. It is to be allowed only if the partnership deed provides for it.

- No interest on capital is payable if the firm is working at a loss.

Journal Entries

- To provide interest on on capital

Interest on capital A/c Dr

To Partners capital A/c(Individually)

- To close the Interest on capital Account

P&L Appropriation A/c Dr

To Interest on capital A/c

Interest on capital = Capital X Rate X Period for which amount remained in the business.

Case – 1 – When there is no addition to or withdrawal from capital during the year

Interest is calculated for whole year on the opening capital

Interest on capital=Opening capital X Rate X 12/12(Period)

Questions

Q9 – Charu and Damu are partners sharing profits and losses equally.Their capitals on 1 st January 2010 was Charu – 20,000 , Damu – 30,000.calculate interest on capital @6% p.a. as on 31 st Dec: 2010

Ans : Charu – 1200, Damu – 1800

Case-2 When there is additional capital contribution during the accounting year

Interest on capital = For Opening capital – Full year

For Additional capital – On the date to the end of the financial year.

Ex: Opening capital of Mr. A is 50,000,Rate of interest is 10%, he brought additional capital on july31 Rs.20000

Interest on capital = For opening capital 50000 X10100X 1212 = 5000 (For 12 months)

For additional capital 20000 X10100 X12 5 = 833 (for 5 months)

Interest on capital due to Mr.A is (5000+833) Rs 5833

Questions

Q10 – A and B are Partners in a firm.Their capital accounts showed the balance on 1st January2010 as A Rs.30,000 and B Rs.20,000.During the year 2010 A introduced additional capital of Rs.10,000 on 1st june 2010 and B brought in Rs.15,000 on 1st july 2010.The Interest on capital is allowed @6% p.a. Accounts are closed on December 31 evey year.Calculate the interest on capital to be allowed to A and B for the year 2010.

Q11 – Amal and Balu are Partners in a firm.Their capital accounts showed the balance on 1 st January 2010 as Amal Rs.30,000 and Balu Rs.20,000. During the year 2010 Amal introduced additional capital of Rs.10,000 on 1 st June 2010 and Balu brought in Rs.15,000 on 1 st July2010.The interest on capital is allowed @ 6% P.a. Accounts are closed on December 31 st every year. Calculate the Interest on capital to be allowed to Amal and Balu for the year 2010.

Ans : Amal – 2150, Balu – 1650

Q12- Saloni and Srishti are partners in a firm. Their capital accounts as on April 01. 2019 showed a balance of Rs. 2,00,000 and Rs. 3,00,000 respectively. On July 01, 2019, Saloni introduced additional capital of Rs. 50,000 and Srishti, Rs. 60,000. On October 01 Saloni withdrew Rs. 30,000, and on January 01, 2020 Srishti withdraw, Rs. 15,000 from their capitals. Interest is allowed @ 8% p.a. Calculate interest payable on capital to both the partners during the financial year 2019–2020.

Ans: Saloni – 17,800, Srishti – 20700.

Q 13 – Jeeja and Rekha are partners in a firm. Their capital balances as on 01-04-2020 were Jeeja 1,50,000 and Rekha 2,00,000. On 1-10-2020 Jeeja introduced additional capital of 50,000. Calculate the interest on capital @ 10% per annum assuming that they closes their books of account on 31st March every year.

Ans : Jeeja – 17500, Rekha – 20000

Case – 3

If opening balance of capital Account is not given

Questions

Q 14 – A and B are partners in a business.Their at the end of the year were Rs.46,000 and Rs.34,000 respectively. During the year 2011 A’s drawing and B’s drawings were Rs.6,800 and 10,700 respectively. Interest on drawings charged was , A Rs.200 and B Rs.300. A had been credited with a salary of Rs.3,000 and B with a commission of Rs.4,000. Profits during the year after after making the above mentioned adjustments were Rs.30,000. Calculate Interest on capital @ 6% for the year ending 31 st December 2011.

Ans :A 35000 – 2100, B – 26000-1560.

Case – 4 When there is withdrawal out of capital(From) during the year

Interest on capital = For Opening Capital – Full year = xxxx

Less : Interest for withdrawal amount – xxxx ( From the date of withdrawal to closing date )

Ex: Opening capital of Mr. A is 50,000,Rate of interest is 10%,he withdraw capital on july31 Rs.20000

Interest on capital = For opening capital 50000 X10/100 = 5000

Less interest for withdrawal amount = 20000*10/100*5/12 for 5 months, after withdrawal)

Interest on capital due to Mr.A is (5000-833) Rs 4167

Questions

Q15 – Saloni and Srishti are partners in a firm. Their capital accounts as on April 01. 2019 showed a balance of Rs. 2,00,000 and Rs. 3,00,000 respectively. On July 01, 2019, Saloni introduced additional capital of Rs. 50,000 and Srishti, Rs. 60,000. On October 01 Saloni withdrew Rs. 30,000, and on January 01, 2020 Srishti withdraw, Rs. 15,000 from their capitals. Interest is allowed @ 8% p.a. Calculate interest payable on capital to both the partners during the financial year 2019–2020.

Ans: Saloni – 17,800, Srishti – 20700.

Q16- M and N are partners sharing profits and losses in the ratio of 3:2.Their capital balances on 1st january 2010 were Rs.40,000 and Rs.30,000 respectively. On 1st July 2010, M had withdrawn Rs.10,000 and on 1st september 2010 N had withdrawn Rs.6,000 out of capital. Calculate Interest on capital @ 6% per annum for the year ending 31st December 2010.

Ans : M – 2,100, N-1,680

Interest on Drawings

Guarantee of Profit to a Partner

Sometimes, on admission of a new partner, the existing partners may give an assurance to the incoming partner that he shall be given a minimum amount of profit irrespective of the firm’s actual profit.The newly admitted partner enjoys the privilege of getting the guaranteed profit.The deficiency is borne by all other partners in their Profit sharing Ratio.

Steps

- Distribute the profit to all partners as per profit sharing ratio.

- Calculate the deficiency or guaranteed partner ( Agreed amount – actual profit share)

- Deduct the share of deficiency from other partner’s profit share ( deficiency X PSR of remaining partner’s only)

- and add all the amounts to guaranteed partners share of profit.

Ex: A,B and C, Profit sharing ratio is 2:3:1, C is guaranteed profit of Rs 15,000, Profit for the year Rs 60,000

- Profit share A = 60000 X 26 = 20000

B = 60000 X 3/6 = 30000

C = 60000 X 1/6 = 10000

- Deficiency of C 5000 (15000- 10000=5000)

- Share of deficiency borne by A= 5000 X 2//5 = 2000

Share of deficiency borne by B= 5000 X 3/5 = 3000

- New share of Profit A = 20000 – 2000 = 18000

New share of Profit B = 30000 – 3000 = 27000

New share of Profit C = 10000 + 2000+3000 = 15000

Questions

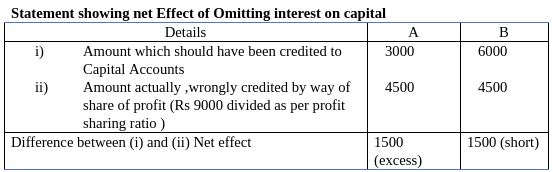

Past Adjustments

Sometimes a few omissions or errors are found in partnership accounts after final accounts have been prepared and the profits distributed among t he partners.The omission in respect of Interest on capital,salary,commission etc. All these need adjustments for correction instead of altering old accounts by way of

- Through “P&L Adjustment A/c” or

- Directly in the capital A/c of partners.

- Through P&L Adjustment A/c ( Ex :Interest on Capital )

Journal Entry

Right Entry

P&L Adjustment A/c Dr 9000

To A’s capital A/C 3000

To A’s capital A/C 6000

(interest on capital is credited to capital a/cs)

Correction Entry

A’s capital A/C 4500

B’s capital A/C 4500

To P&L Adjustment A/c Dr 9000

(The amount debited to capital accounts in PSR, which are credited wrongly before)

- Directly partners Capital Accounts

For direct adjustment in partners capital account prepare a statement to ascertain the net effect of omission on partners capital account.

In order to rectify this error :-

A’s capital A/c Dr 1500

To B’s capital A/c 1500

Questions

Previous Year Questions : Click here