Presentation

Reconstitution of a partnership Firm- Admission of a partner

Partnership is the result of an agreement between partners for sharing profit of the business.Any changes in the relationship among partners, the existing agreement comes to end and a new agreement comes into being.

Reconstitution of a partnership means change in the nature of relationship amongst members.

Different Modes/ Occasion of Reconstitution

- Admission of a new partner

- Change in the profit sharing ratio of existing partners

- Retirement of a partner

- Death of a partner

1-ADMISSION OF A PARTNER

Inclusion of a person as a new partner to an existing partnership firm is called Admission of a Partner. A firm requires additional capital or managerial help or both for the expansion of its business a new partner may be admitted.When the time of admission the partnership is reconstituted with a new fresh agreement.

An incoming partner acquires two main rights in the firm, they are:-

- Right to share the asset of the firm – For this he should bring Capital

- Right to share the profit of the firm – For this he should bring Goodwill/Premium

Accounting adjustments on Admission of a Partner

- Capital of the new partner

- Calculation of new profit sharing ratio

- Calculation of sacrificing ratio

- Treatment of Goodwill

- Revaluation of assets and liabilities

- Distribution of reserves and accumulated profits and losses

- Adjustment of capital accounts of partners

A-Capital of New partner

At the time of admission an incoming partner brings capital in cash or assets.

Cash / Asset A/c Dr

To New partner’s capital A/c

(Cash or assets brought as capital)

Ex: Cash A/c Dr 50,000

Land A/c Dr 100,000

To New Partner’s capital A/c 1,50,000

Q1 – Manu and Sanu are partners in a firm sharing profits in the ratio of 3:2.They decided to admit Amal in to partnership for 1/5 th share of profit.Amal brings Rs.40,000 cash and land worth Rs.80,000 towards his capital contribution.Give journal entry to record the capital brought by amal.

B-Calculation of New profit sharing ratio

New profit sharing ratio is the ratio in which all partners,including new partner share the future profit and losses.

The new profit sharing ratio will be calculated by how the new partner acquires his share from the old partners

- New partner gets share from total profit (Ex: 1/5 from total profit) –

New profit sharing ratio of old partner = remaining share X Old profit sharing ratio of partner

Q2 – Anil and Vishal are partners sharing profits in the ratio of 3:2. They admitted Sumit as a new partner for 1/5 share in the future profits of the firm. Calculate new profit sharing ratio of Anil, Vishal and Sumit.

Ans:NPSR 12:8:5.

Q3 – A and B are partners sharing profits and losses in the ratio of 3:2. C is admitted for 1/6th share of profits.calculate new profit sharing ratio o the partners.

Ans : 3:2:1

- New partner may acquire equally with the old partner

New Ratio of old partner = Old ratio – portion given to new partner

Q4 – A and B are partners sharing profits and losses in the ratio of 5:3 . C is admitted in the firm with ⅕ th share in the profits which he acquired equally from both ,i.e, 1/10 from A and 1/10 from B . Calculate the new profit sharing ratio.

Ans :21:11:8

Q5 – Akshay and Bharati are partners sharing profits in the ratio of 3:2. They admit Dinesh as a new partner for 1/5th share in the future profits of the firm which he gets equally from Akshay and Bharati. Calculate new profit sharing ratio of Akshay, Bharati and Dinesh.

Ans: 5:3:2

- New partner acquire it in some agreed ratio

New Ratio of old partner = Old ratio – portion acquired by new partner

Q6 – A and B are partners sharing profits and in the ratio of 3:1. C is admitted in the firm with ⅛ th share , which he acquires 1/32 from A and 3/32 from B . Calculate the new profit sharing ratio.

Ans:23:5:4

Q7 – Anshu and Nitu are partners sharing profits in the ratio of 3:2. They admitted Jyoti as a new partner for 3/10 share which she acquired 2/10 from Anshu and 1/10 from Nitu. Calculate the new profit sharing ratio of Anshu, Nitu and Jyoti.

Ans : 4 : 3 : 3.

- New partner acquire it wholly from one partner

New Ratio of that partner = Old ratio – portion given to new partner

Q8 – A and B are partners in a firm sharing profits and losses in the ratio of 4:1. C is admitted in to partnership with ¼ th share in profits which he acquires wholly from A. Calculate the new profit sharing ratio.

Ans: 11:4:5

Q9 – Das and Sinha are partners in a firm sharing profits in 4:1 ratio. They admitted Pal as a new partner for 1/4 share in the profits, which he acquired wholly from Das. Determine the new profit sharing ratio of the partners.

Ans : 11:4:5

- New partner acquire it in the form of certain fraction of old partners share in profit

New Ratio of old partner = Old ratio – portion given to new partner(old ratio X Fraction given to new partner)

Q10 – A and B are partners sharing profits in the ratio of 3:1. C is admitted as a partner in the firm. A surrendered 1/32 of his share and B 3/32 of his share in favour of C. Calculate the new profit sharing ratio.

Ans:93:29:6

Q11 – Ram and Shyam are partners in a firm sharing profits in the ratio of 3:2. They admit Ghanshyam as a new partner. Ram sacrificed 1/4 of his share and Shyam 1/3 of his share in favour of Ghanshyam. Calculate new profit sharing ratio of Ram, Shyam and Ghanshyam.

Ans : 27:16:17

C- Calculation of sacrificing Ratio

The ratio in which the old partners have agreed to sacrifice their share in favor of new partner is called sacrificing ratio.

The newly admitted partner is required to compensate the old partners for his right to share in the future profits of the firm. The compensation or premium brought by new partner must be shared by the old partners in the sacrificing ratio.

Sacrificing ratio = Old ratio of a partner – New ratio of a partner

Q12 – Rohit and Mohit are partners in a firm sharing profits in the ratio of 5:3. They admit Bijoy as a new partner for 1/7 share in the profit. The new profit sharing ratio will be 4:2:1. Calculate the sacrificing ratio of Rohit and Mohit.

Ans: Sacrificing ratio among Rohit and Mohit will be 3:5.

Some times ,while the admission of a new partner, old partners rearrange their shares in profits.In such a way that some of the old partners may also gain additional shares in profits.in such a case , the gaining old partner will also be required to compensate the partner who makes the sacrifice.

Gaining Ratio = New share – Old share

Q13 –Ramesh and Suresh are partners in a firm sharing profits in the ratio of 4:3. They admitted Mohan as a new partner. The profit sharing ratio of Ramesh, Suresh and Mohan will be 2:3:1. Calculate the gain or sacrifice of old partner.

Ans:Ramesh Sacrifice – 10/42 , Suresh’s Gain – 3/42

Click here for more videos

D-Treatment of Good will

A well established business can earn more profit compared to a newly set up business because of its good name,reputation and business connections.The monetary value of such an advantage is known as Goodwill. It can be defined as “ the present value of a firm’s anticipated excess earnings”.

The excess super and extra ordinary profit earned is termed as Goodwill.

Factors affecting the value of goodwill

- Location of business

- Nature of business

- Efficiency of management

- Time factor

- Market situations

- Special advantages

Need for valuation of Goodwill

Arises Under the following circumstances:-

- Change the profit sharing ratio of the existing partners

- Admission of a partner

- Retirement of a partner

- Death of a partner

- Dissolution / sale of partnership

- Amalgamation of firms.

Methods of valuation of goodwill

Usually the method of valuation of goodwill will be mentioned in the partnership deed.The important methods are:-

- Average profit method

- Weighted average profit method

- Super profit method

- Capitalisation method

- Capitalisation of average profit

- Capitalisation of Super profit

1-Average profit method(Simple average method)

Under this method goodwill is valued a certain years of purchase of the average profit of the given number of years.

Goodwill = Average profit X No.of years purchase

Average profit = Total profit for past few years / No.of year

| Ex: profits for 3 years, 30,000 , 40,000 , 20000, GW is 3 year purchase of Average profit Average Profit ==30000+40000+200003=30000Goodwill = Ap X 3 year Purchase of AP, = 30000 X 3 = 120000 |

- Loss also be considered ( 40000+30000-1000(loss) AP= 60000)

- Abnormal Gain or Loss not included in profit (Total Profit 37500, abnormal gain 2500,so ,profit is 37500 – 2500 =35000)

Questions

Q14 –The profit for the five years of a firm are as follows – year 2013 Rs. 4,00,000; year 2014 Rs. 3,98,000; year 2015 Rs. 4,50,000; year 2016 Rs. 4,45,000 and year 2017 Rs. 5,00,000. Calculate goodwill of the firm on the basis of 4 years purchase of 5 years average profits.

Ans: Rs. 17,54,400

Q15 – Calculate the amount of goodwill at three year’s purchase of the last five years’s average profits.The firm earned profits during the first three years at Rs.25,000,Rs.23,000 and Rs.30,000 and suffered losses of Rs.10,000 and Rs.8,000 in the 4th and 5th year.

Ans:36,000

Q16 – The following were the profits of a firm for the last three years.Year ending Dec.31

2008 – 3,75,000 ( Including an abnormal gain of Rs.25,000)

2009 – 6,00,000 (After charging an abnormal loss of Rs.50,000)

2010 – 2,60,000 (excluding Rs.60,000 payable on the insurance of plant and machinery)

Calculate the value of goodwill on the basis of two year’s purchase of the average profits for the last three years.

Ans:8,00,000

2-Weighted average profit method

In simple average profit method the weightage given for all years is equal.It is considered to be better to give higher weightage to profit in recent years than those of the earlier years.Here weight like 1,2,3…given to the respective years(Weighted average method should be used only if specified)

Goodwill = Weighted AP X No.of years Purchase

Weighted AP = Product total / Weight total

Ex:

| Year | Profit | Weight | Product(Profit X Weight) |

| 2011 | 5000 | 1 (Assign the weight) | 5000 |

| 2012 | 8000 | 2 | 16000 |

| Total weight = 3 | Total product = 21000 |

Weighted AP = 21000/3 = 7000

GW = 7000 X No.of year purchase

Questions

Q17 – The profits of a firm for the five years ending 31st March were as follows.

2012-13 – 23,000

2013-14 – 23,000

2014-15 – 24,000

2015-16 – 26,000

2016-17 – 20,000

Calculate the value of goodwill on the basis of three year’s purchase of weighted average profits.The appropriate weights for the last five years were 1,2,3,4 and 5 respectively.

Ans:69,000

Q18 – The profits of firm for the five years are as follows:

Year Profit (Rs.)

2012–13 – 20,000

2013–14 – 24,000

2014–15 – 30,000

2015–16 – 25,000

2016–17 – 18,000

Calculate the value of goodwill on the basis of three years’ purchase of weighted average profits based on weights 1,2,3,4 and 5 respectively.

Ans : Rs. 69,600

3-Super Profit Method

The goodwill under the super profit method is ascertained by multiplying the super

profits by certain number of years’ purchase.Super profit is the excess of actual profit over the normal profit.Normal profit is termed as normal rate of return on capital employed .

Steps involved in the calculation of Goodwill

- Calculate the Average profit

- Ascertain the Normal profit, Normal profit = Capital employed X normal rate of return

- Calculate the Super Profit , Super profit = Average Profit – Normal Profit

Calculate the Goodwill by multiplying the super profit by the decided number of years

Questions

Q 19 – Profits of the firm for the last five years were:

2010 – 35,000

2011 – 45,000

2012 – 32,000

2013 – 28,000

2014 – 20,000

The capital employed to the firm is Rs.2,50,000. A fair return on the capital having regard to the risk involved is 10%.

Calculate the value of goodwill on the basis of three year’s purchase.

Ans: 21000

Q 20 – The books of a business showed that the firm’s capital employed on December 31, 2015, Rs. 5,00,000 and the profits for the last five years were: 2010–Rs. 40,000: 2012-Rs. 50,000; 2013-Rs. 55,000; 2014- Rs.70,000 and 2015-Rs. 85,000.

You are required to find out the value of goodwill based on 3 years purchase of the super profits of the business, given that the normal rate of return is 10%.

Ans :Rs. 30,000

Q21 – The profit for the last five years of a firm were as follows :

Year Profit

2014 – 62,000

2015 – 58,000

2016 – 84,000

2017 – 78,000

2018 – 80,000

Capital employed in the firm is 5,00,000. Calculate the value of goodwill on the basis of 3 years purchase of Super Profit, assuming that the normal rate of return on capital employed is 12%.( March 2020)

Ans :37200

Q 22 – Consider the following information and calculate Goodwill by super profit method

- Total capital employed Rs.1,00,000

- Normal rate of return 8%

- Average profit for the last 5 years Rs.12,000

- Remuneration to partners Rs.3,000

- Goodwill is estimated at 3 years purchase of super profit. (May 2013)

Ans:3,000

4-Capitalisation Method

Under this method Goodwill can be calculated by

- Capitalising of average profit

- Capitalising Super profit

a)Capitalising average profit

Goodwill is ascertained by deducting the Net tangible asset from the total capitalised value of average profit.

Net tangible asset = Total tangible asset – liabilities outside

Capitalised value is calculated by capitalising the Average profit on the basis of Normal rate of return

Steps involved in the calculation of Goodwill

- Find out the average profits of the past few years

- Capitalise the average profits on the basis of normal rate of return.This will give

total capitalised value of business.

Capitalised value = average profit X 100/Normal rate of return

- Ascertain the actual capital employed by deducting the outsiders liability from total assets(excluding goodwill)

- Compute the value of Goodwill by deducting net asset from the total value of business.

Questions

Q 23 – A business has earned average profits of Rs.80,000 during the last few years and the normal rate of return in the similar type of business is 10%.Find out the value of goodwill by capitalisation method,given that the assets of the firm amount to Rs.7,50,000 and liabilities to Rs.1,00,000.

Ans:1,50,000

Q 24 – A business has earned as average profit of Rs.1,00,000 during the last few years and the normal rate of return in similar business is 10%. Find out the value of goodwill by capitalisation method.given that the value of net assets of the business is Rs.8,20,000 ( June 2012)

As :1,80,000

Q25 – A business has earned average profits of Rs.1,44,000 during the last few years and the Normal rate of return in similar type of business is 12%.The net assets of the firm are Rs.8,20,000. Arun and company are decided to acquire the business.Help him to calculate the Goodwill by capitalisation method. (March 2014) Ans :3,80,000

b)Capitalisation of Super profit

Here total value of business is calculated by capitalising the value of super profits on the basis of normal rate of return.

Steps –Calculating Goodwill

- Calculate the average profit

- Calculate the total capital employed (Total assets-Out sider’s liability)

- Calculate the normal profit on capital employed at the Normal rate of return

Normal Profit = capital employed X Normal rate of return

- Calculate super profit( Average profit – Normal profit)

- Find out Goodwill = Super profit X Normal rate of return

Questions

Q 26 – Following relate to the profit earned by a firm for the last four years

2012 – 15,000

2013 – 25,000

2014 – 65,000

2015 – 75,000

The total assets of the firm are Rs.6,40,000 and outside liabilities Rs.1,40,000. Normal rate of return is 6%. Calculate goodwill of the firm under capitalisation of super profit method.

Ans : 2,50,000

Q 27 – A business has earned average profits of Rs. 1,00,000 during the last few years and the normal rate of return in a similar business is 10%. Ascertain the value of goodwill by capitalisation Super profits method, given that the value of net assets of the business is Rs. 8,20,000(Capital employed).

Ans : 1,80,000

Accounting Adjustment of Goodwill

When a new person is admitted , he is required to compensate the existing partners for giving him a share of future profits. For this he has to make payment to them,it is known as Share of Goodwill or Premium. Alternatively he may agree that Goodwill accounts be raised in the books by giving necessary credit to the old partners. Thus Goodwill can be treated in two ways,

They are:-

- By premium Method

- Revaluation Method

Premium Method

This method is followed when the new partner pays his share of goodwill in Cash.The amount of premium brought by the new partner is shared by the existing partners in the ratio in which they sacrifice their profit share.

- Goodwill paid privately

Sometimes ,the new partner brings in his share of goodwill in cash and the same is paid to old partners privately, ie outside the business, no entry is to be made in the books.

- The new partner brings in his share of goodwill in cash which is retained in the business

Journal Entries :-

- Cash a/c Dr

To Goodwill a/c

(The amount actually brought in by new partner as goodwill)

- Goodwill a/c Dr

To Old partners capital A/c (Individually)

(goodwill distributed among the old partners in their sacrificing ratio)

Or

Cash A/c Dr

To Old Partners capital A/c(Individually)

(Cash brought in for goodwill credited to old partners in their sacrificing ratio)

Note : The goodwill/premium brought in by the incoming partner is shared by the old partners in their sacrificing ratio because they forgo their future profits in this ratio.

Questions

Q 28 – Rajan and Mohan are in partnership sharing profits and losses in the ratio of 3:2.They admit Govind into partnership who pays Rs.40,000 for his capital and Rs.5,000 as goodwill for a sixth share in future profits.

Show he journal entries necessary to record the above.

Note: Since the future profits sharing ratio is not given ,the sacrificing ratio of the old partners will be the same as that of their old profit sharing ratio.

Q 29 – Abhinav and Adarsh are partners in a firm sharing profits and losses in the ratio of 5 : 3. Ananya is admitted in the firm for 1/5th share of profits. She has to bring in 20,000 as capital and 4,000 as her share of goodwill. Give the necessary journal entries if the amount of goodwill is retained in the business. (March 2021)

- 3 The new partner brings in his share of goodwill in cash and the same in full or part is withdrawn by the old partners

Journal entries:-

A – Cash A/c Dr – Bring the Goodwill

To Goodwill A/c

B – Goodwill A/c Dr – Sharing by old partners

To Old Partners capital A/c

C – Old partners’ capital A/c – Withdrawn by old partners

To Cash A/c

(The amount of goodwill withdrawn by the old partners)

Questions

Q 30 – Amal and sunil are in partnership sharing profits and losses in the ratio of 3:2.They admit Govind into partnership who pays Rs.40,000 for his capital and Rs.9,000 as his share of goodwill.Half of the goodwill is withdrawn by the partners .They agree to share the profits and losses in the ratio of 4:3:3 in future.

Give necessary journal entries to record the above.

Q 31 – Sunil and Dalip are partners in a firm sharing profits and losses in the ratio of 5:3. Sachin is admitted in the firm for 1/5th share of profits. He brings in Rs. 20,000 as capital and Rs. 4,000 as his share of goodwill by cheque. Give the necessary journal entries,

(a) When partners decided to retain goodwill in business.

(b) When the amount of goodwill is fully withdrawn.

(c) When 50% of the amount of goodwill is withdrawn.

4- Share of Goodwill brought in kind

In this situation, the new partner brings in his share of goodwill in the form of assets, instead of cash

Journal entries:-

A – When capital and Goodwill are brought in the form of assets

Assets (individually) A/c Dr

To new partners capital A/c

To Goodwill A/c

(Assets brought in by the new partner towards towards capital and share of goodwill)

B-To share Goodwill among the old partners

Goodwill A/c Dr

To Old partners capital A/c (Individually)

(Goodwill amount transferred to old partners’ capital account in the sacrificing ratio)

Questions

Q 32 – A and B are partners in a firm sharing profits in the ratio of 3:2 on 1st january 2011 they admit C as a new partner for ¼ share in the profits. C is admitted the following assets towards his capital and for premium. Stock – Rs.50,000, Debtors – Rs.70,000 , Buildings Rs.1,00,000 and Plant and Machinery Rs.80,000. For the purpose of C’s admission ,the goodwill of the firm was valued at Rs.3,60,000. Record the necessary journal entries in the books of the firm on C’s admission.

Hint : C’s Share of goodwill =3,60,000*¼ = 90,000

5-New partner brings in only a portion of the goodwill in cash

Sometimes ,the new partner brings only a portion of goodwill.The remaining amount adjusts from his capital account.

Journal entries:-

a-For the amount of goodwill brought in cash

Cash A/c Dr

To Goodwill a/c

(For the amount of goodwill brought in cash )

b-For transferring the Goodwill (Share of new partner) Old partners

Goodwill A/c Dr -Amount actually brought in cash

New Partner’s Capital A/c -Remaining amount of Goodwill

To Old partners capital A/c -Total premium to old partners

(Goodwill shared by old partners in the sacrificing ratio)

Questions

Q 33 – P and S are partners in a firm sharing profits in the ratio of 3:2,They admit T as a new partner for ¼ share in the profits.T brought in Rs.1,00,000 as his capital. His share of goodwill was Rs.16,000.But he was in a position to bring only Rs.10,000. Record necessary journal entries in the books of the firm.

6-New Partner not in a position to bring Goodwill

Some times ,the new partner may not be in a position to bring cash for his share of goodwill.in such a situation the new partner’s capital account is debited for his share of goodwill.

Journal entry:-

For transferring new partner’s share of goodwill to old partners

New partner’s Capital A/c

To Old partners Capital A/c – Individually

(For sharing goodwill by the old partners in the sacrificing ratio)

Question

Q 34 – P and S are partners in a firm sharing profits in the ratio of 3:2,They admit T as a new partner for ¼ share in the profits.T brought in Rs.1,00,000 as his capital. His share of goodwill was Rs.16,000.But he was not in a position to bring goodwill. Record necessary journal entries in the books of the firm.

Revaluation Method

This method is followed when the new partner does not brings in his share of goodwill in cash. In such a situation,the new Goodwill account raised in the books of accounts by crediting the old partners in the old profit sharing ratio.

There are two possibilities:-

- No goodwill appears in books at the time of admission

- Goodwill already exists in the books.

A – No goodwill appears in books at the time of admission

In this method the Goodwill account must be raised at its full value.

Goodwill A/c Dr

To Old Partners’ capital Account

(Goodwill raised at full value in the old profit sharing ratio)

B – Goodwill already exists in the books

If the books already show some balance in the Goodwill account,the adjustment for Goodwill in the old partners capital account shall be made only for the difference between the agreed value and the amount of Goodwill appearing.

- When the value of goodwill appearing in the books is less than agreed value

Agreed value – 40000

In the books of accounts – 30000

Goodwill A/c Dr 10000

To Old partners capital A/c

(Amount of goodwill raised from book value to agreed value)

- When the value of GW appearing in the books is more than the Agreed value

Agreed value – 40000

In the Books of accounts – 45000

Old partners capital A/c Dr 5000

To Goodwill A/c 5000

(Goodwill brought down to its agreed value)

Note: Goodwill shall appear in the B/S at Rs. 40000 in both cases.

Quesions

Q 35 – Ram and Rahim are partners in a firm sharing profits and losses in the ratio of 3:2. Rahul is admitted into partnership for 1/3 share in profits. He brings in Rs. 10,000 as capital, but is not in a position to bring any amount for his share of goodwill which has been valued at Rs. 30,000. Give necessary journal entries under each of the following situations:

(a) When there is no goodwill appearing in the books of the firm;

(b) When the goodwill appears at Rs 15,000 in the books of the firm; and

(c) When the goodwill appears at Rs. 36,000 in the books of the firm.

Q36 – A and B are partners sharing profits and losses equally.They admit C in to partnership and the new ratio is fixed as 4:3:2. C is unable to bring anything for goodwill but brings Rs.25,000 as capital.Goodwill of the firm is valued at Rs.18,000. Give necessary journal entries assuming that the partners decide not to show goodwill in the balance sheet.

Normally,when goodwill is raised it will be shown in the B/S at its agreed value, sometimes the partners may decide that the goodwill should not appear in the firm’s balance sheet,then it has to be written off.

a-GW Raised in the books

Goodwill A/c Dr – Full value credited to old partners cap. A/c in OR

To Old Partner’s Capital A/c

b-GW Writeoff

All Partners Capital A/c Dr

To Goodwill A/c

– Full value written off to all partners including new partner in the new profit sharing ratio.

The net effect of such treatment is old partners capital account credited in the ratio of their sacrifice, and the goodwill shows nil balance.

Hidden Goodwill

If the Value of Goodwill of the firm is not specifically given in the question, it is to be inferred from the arrangement of the capital and profit sharing ratio.

Find out the total capital by multiplying the incoming partner’s capital and profit sharing ratio.

Questions

Q 37 – Hem and Nem are partners in a firm sharing profits in the ratio of 3:2. Their capitals were Rs. 80,000 and Rs. 50,000 respectively. They admitted Sam on Jan. 1, 2017 as a new partner for 1/5 share in the future profits. Sam brought Rs. 60,000 as his capital. Calculate the value of goodwill of the firm and record necessary journal entries on Sam’s admission.

Ans :Sam’s share of GW 22,000,(No cash brought in as goodwill)

6-Adjustment for Reserve and Accumulated Profit/Loss

At the time of admission Reserve or Undistributed Profit/Accumulated Losses of the previous years appearing on the liability side (if loss -Asset side) of balance sheet should be transferred to to the capital accounts of old partners in their old profit sharing ratio.This is to be done even if the question in silent about this.

Journal entries

1-For reserve and undistributed profits –

Reserve/Profit & loss A/c Dr

To Old Partner’s Capital Account

(Reserve or Profit transferred to old partner’s capital A/c in their Old Profit sharing Ratio)

2-For accumulated Losses

Old Partner’s capital A/c Dr

To Profit &Loss A/c

(Accumulated losses transferred to old partner’s capital A/c in their Old Profit sharing Ratio)

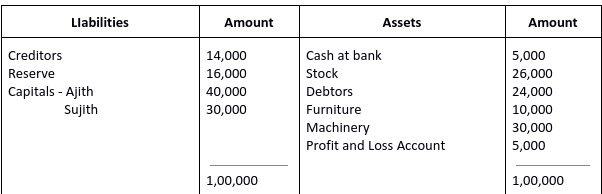

Q 42 – Ajith and Sujith are partners sharing profits and losses in the ratio of 5:3.Their balance sheet as on 31 st March 2020 stood as follows.

Balance sheet as at 31 st March 2020

On 1 st April 2020 ,They admitted to Ram into partnership.

Pass journal entries for adjustment of reserve and accumulated profits/losses at the time of Ram’s Admission.

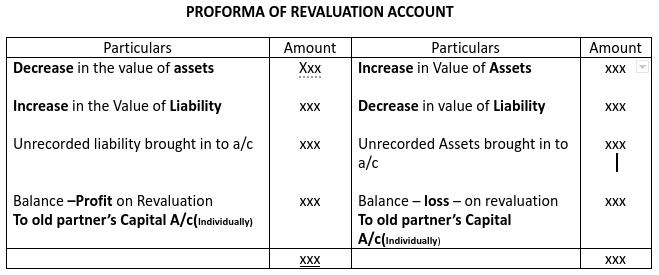

E – Revaluation of Assets and liabilities

On admission of a new partner assets and liabilities are to be revalued and the result (profit/loss)should be transferred to old partners in their old profit sharing ratio. For this a revaluation A/c or P&L adjustment a/c is prepared.It is a nominal account.

Journal entries

| Item | Journal Entry |

| a – For increase the value of assets | Asset A/c Dr To Revaluation Account |

| b – For decrease the value of assets | Revaluation Account To Asset A/c |

| c – For decrease in the amount liability | Liability A/c Dr To Revaluation Account |

| d – For increase in the amount liability | Revaluation Account To LIability A/c |

| e – For an unrecorded asset | Asset A/c Dr To Revaluation Account |

| f – For an unrecorded liability | Revaluation Account To LIability A/c |

| g – For transfer of Revaluation Account credit balance (Profit) | Revaluation Account To Old Partners Capital A/c (individually) |

| h – If debit balance (Loss) | Old Partners Capital A/c (individually) To Revaluation Account |

After effect of Revaluation

Assets and liabilities will now be shown at their revised values in the balance sheet prepared immediately after admission of the new partner.

To watch video : Click here

Questions

Q 38- The following details were noticed in the books of a firm at the time of a partner’s admission. Prepare revaluation A/c from the following.The partners A and B share profits and losses equally.

Ans : Revaluation profit :13000

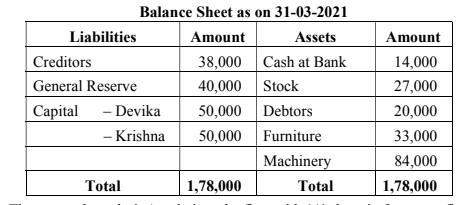

Q39 – Devika and Krishna are equal partners in a firm. Their balance sheet as on March 31, 2021 is given below :

They agreed to admit Amala into the firm with 1/4 share in future profits. They decided to revalue their assets at the time of admission.

(1) Stock is to be revalued at ` 35,000.

(2) Furniture is to be depreciated by 10%.

(3) Machinery is to be revalued at ` 1,00,000.

(4) A provision for doubtful debts is to be created on debtors at 5%.

Prepare Revaluation account.

(Ans : Revaluation profit:19,700)

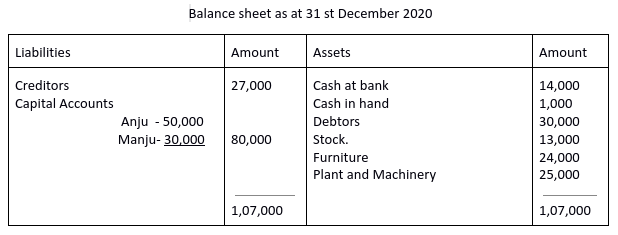

Q 40 – Following is the balance sheet of Anju and Manju who share profits and losses in the ratio of 3:2

On that date Sanju was admitted with a capital of Rs.20,000 and ⅕ th share in profits and for which purpose assets and liabilities are revalued as follows:

- Value of Plant & machinery be reduced by 10%

- Depreciate furniture by Rs.1,500

- Stock is valued at Rs.16,000

- Create a provision @5% on debtors and Rs.2,000 to be created towards an outstanding repair bill.

- The value of creditors found to be Rs.24,000

- Investment worth Rs.5,000 not appearing in the books should be duly recorded.

Give journal entries and prepare revelation account . Also prepare the balance sheet of the reconstituted firm after admission of the new partner.

(Ans : Revaluation profit -3,500,Capital Account balance – Anju – 52,100, manju – 31,400,Sanju – 20,000. Balance sheet total -1,29,500)

Q41– Sathy and Varsha are partners in a firm sharing profit and losses in the ratio of 3 : 1.

Their Balance Sheet as on 1st January 2019 was as follows :

Suma is admitted into the firm with 1⁄4 share in profits on the following terms :

(1) Market value of Investment are to be taken at ` 70,000.

(2) Buildings were found undervalued by ` 4,000.

(3) Stock is revalued at ` 26,000.

(4) It was found that creditors included a sum of ` 3,000 which was not to be paid.

(5) Machinery is to be depreciated by 10%.

Prepare Revaluation Account.

(Ans : Revaluation profit – 16000)

More Questions

Q 43- Abhirami and Dayana are partners in a firm sharing profits and losses equally.Their balance sheet as on 31st Dec. 2018 were as follows :

They decided to admit Manju as a partner on that date for a 1/4 share in profit and

the following were agreed upon :

(i) Manju contributed ` 20,000 as capital and ` 10,000 as her share of goodwill.

(ii) Furniture is valued at ` 28,000.

(iii) Land and buildings found appreciated by 10%.

(iv) A provision of 5% on debtors were created for bad debts.

Prepare the Revaluation account and Capital account of the firm after admission.

(Revaluation loss :2400,Capital – Abhirami- 40800, Dayana-42800,Manju – 20000

Q 44 – Given below is the Balance Sheet of Ramu and Jafar who were sharing Profits and Losses in the ratio of 3 : 2 as on 31st December, 2015.

Shoby is admitted as a partner on the date of Balance Sheet on the following terms :

(a) Shoby will bring ` 30,000 as capital and ` 12,000 for his share of goodwill for ¼ share in profits.

(b) Plant and Machinery is depreciated by ` 8,000.

(c) Stock is found overvalued by ` 3,000.

(d) A provision for doubtful debts is to be created at 10% on debtors.

(e) Creditors were unrecorded to the extent of ` 1,000.

Prepare Revaluation Account, Partners Capital Account and the new Balance Sheet after the admission of Shoby. (2020 SAY)

(Ans : Revaluation loss 14,700, Capital A/cs Ramu -48380,jafer 38920,shoby 30000,Balance sheet total :160300)

Q 45 – Given below is the Balance Sheet of Amal and Midhun who share profits and losses in the ratio of 3 : 2.

Mr. Faisal is admitted into the partnership on the following terms :

(i) New partner has to bring in 25,000 as capital and 10,000 as goodwill for 1/6th share.

(ii) A creditor of 1,000 will not claim his amount.

(iii) Furniture is revalued at 20,000.

(iv) Stock reduced by 2,000.

(v) Depreciation on machinery @ 10% p.a.

Prepare the Revaluation A/c., Partners’ Capital A/c. and the Balance Sheet after admission.

(Ans:Revaluation loss :11,000, Amal – 39400. Midhun – 29600, faisal -25000, balance sheet -143000)

Q 46 – Haritha and Samitha are partners in a firm sharing profits and losses in the ratio of 5:3. The following is their balance sheet as on 31’t March, 2018.

They decided to admit Sameera into partnership on l’t April, 2018 on the following terms:

(1) That Sameera has to bring Rs.25,000 as capital for 1/4 share in future profits.

(2) That Sameera will bring her share of goodwill Rs. 9,000.

(3) The value of Land and Buildings be appreciated and brought upto Rs.45,000.

(4) Furniture to be reduced by 10%.

(5) Stock revalued at Rs. 16,000.

(6) Creditors of Rs. 2,000 is not likely to be claimed.

Prepare the Revaluation Account, the Capital Accounts of Partners and Balance Sheet of the new firm.

(Ans:Revaluation Profit -3800,Capital – Haritha-53000,Samitha – 37800,Sameera – 25000,Balance sheet total – 145800)

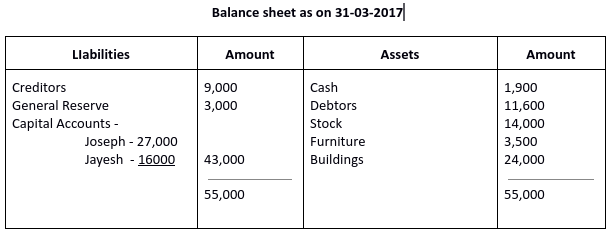

Q 47 – Following is the Balance sheet shows the financial position of Joseph and Jayesh. Sharing profits and losses in the ratio of 2:1

They agreed to admit Jobish into partnership and given him ¼ share in profits, with the following items:

- Jobish should bring Rs.20,000 as his capital and Rs.6,000 as his share of goodwill in cash

- Furniture depreciated by 12% and stock depreciated by 10%

- Buildings appreciated by Rs.10,000

- Create provisions for doubtful debts at 5% of debtors.

Prepare Revaluation Account, Partners Capital Accounts and the New Balance sheet.

(Ans:Revaluation Profit – 7600,Capital Accounts – Joseph – 38067,jayesh -21533, Jobish – 20000,Balance sheet – 88600)

48 – Following is the Balance Sheet of Leena and Jyoth who share profits in the ratio of 3:1 as on 31 March, 2021.

Rajesh is admitted as a partner on the date of the balance sheet as per the following terms :

1. Rajesh will bring in Rs. 1,00,000 as his capital for 1/5 share in profits.

2. Plant & Machinery is to be appreciated to Rs. 60,000 and the value of buildings is to be reduced by 10%.

3. Stock is revalued at Rs. 20,000.

4. Investment worth Rs. 2,500 is to be taken into account.

Prepare Revaluation Account.

Ans: Revaluation Profit – Leena – 7875, Jyothi – 2625

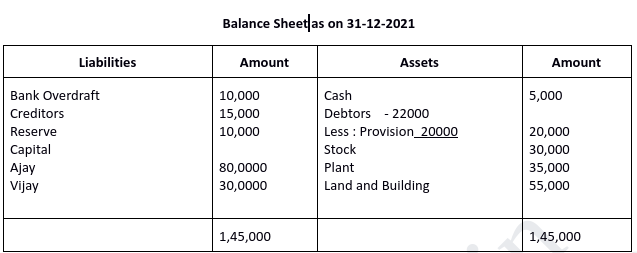

49 – Ajay and Vijay were partners in a firm sharing profits in the ratio 3 : 2. On 1-1-2022 they admitted Sujay into partnership for 1/5 share of profits. The balance sheet on 31-12-2021 was as follows :

It was agreed that

(a) The value of Land and Building is increased by ` 15,000.

(b) The value of Plant is reduced by ` 10,000.

(c) The provision for doubtful debt is to be increased by ` 1,000.

(d) Sujay has to bring in ` 50,000 as capital and ` 4,000 as premium for goodwill.

Prepare Revaluation Account, Partners Capital Account and Balance Sheet after the admission of Sujay. (Say 2023 )

Ans : Revaluation Profit : 6000 , (2400,1600) Capital Acs ,Ajay-90800,Vijay – 37200,Sujay -50000, B/s – 2,03,000)

7-Adjustment of capital Accounts of partners

At the time of admission of new partner the capitals of all partners are adjusted in their profit sharing ratio.This are done in two ways:-

1-Adjustment of old partners capital accounts on the basis of incoming partner’s capital.

If the capital of new partner is given,the same can be used as a base for calculating the new capitals of old partners.on this basis, the entire capital of the firm can be ascertained and the capital of each partner is arrived at according to the profit Sharing ratio. Capitals should be arrange after all adjustment are made.

Ex: A and B , ratio is 3:2,with capitals of 80,000 and 65,000. they admitted C with 1/6 share for a capital of Rs.30,000

So. Total capital is 30000×6/1=1,80,000

A’s new share =5/6 x 3/5=3/6, capital is 180,000×3/6=90,000

B’s new share = 5/6 x 2/5=2/6, capital is 1,80,000x 2/6=60,000.

Capitals ,After all adjustments A=80000 – 90000 = -10000, he should bring Rs 10000

B=65000 – 60000 = 5000, he will withdraw Rs 5000

Journal entry

Cash/Bank A/c Dr 10000

To A’s Capital A/c 10000

B’s Capital A/c Dr 5000

Cash /Bank A/c 5000

Question

Q 48 – A and B are partners sharing profits in the ratio of 2:1. C is admitted into the firm for 1/4 share of profits. C brings in Rs. 20,000 in respect of his capital. The capitals of old partners A and B, after all adjustments relating to goodwill, revaluation of assets and liabilities, etc., are Rs. 45,000 and Rs. 15,000 respectively. It is agreed that partners’ capitals should be according to the new profit sharing ratio.

Determine the new capitals of A and B and record the necessary journal entries assuming that the partner whose capital falls short, brings in the amount of deficiency and the partner who has an excess, withdraws the excess amount

Ans : A withdraw – 5000, B brings – 5000)

2-Bringing in proportionate capital by the incoming partner based on the capitals of existing partners.

If the new partner is to bring in proportionate capital,the amount will be ascertained on the basis of the total capitals (after all adjustments are made)of the existing partners and the total of their share of profits.

Steps to ascertain the capital to be brought in by the incoming partner:-

1-Totalup the capital of old partners(after all adjustments for Goodwill,revaluation etc)

2-Add Up the new profit sharing right of old partners

3-Consider the total capital using new profit sharing ratio

4-Ascertain the capital to be brought in by the incoming partner according to his profit sharing rights.

Ex: A and B, capitals of 20,000 and 16,000 with Profit sharing ratio 3:2, C admitted with 1/5 share

The share of A&B , (remaining share)=4/5,

The capital of A&B is 20,000+16,000=36,000

So ,total capital of the firm is 36000 x 5/4=45,000.

C will bring his share 45,000 x 1/5 = 9000.

Questions

Q 49 – C is admitted with ⅕ th share of profit into a firm having already A and B are partners.The profit sharing ratio between A and B is 3:2. A and B have capital balance of Rs.40,000 and 32,000- respectively after making all adjustments in the capitals.It is agreed that C’s capital should be proportionate to his profit sharing ratio. Calculate the amount of capital to be brought in by C.

Ans: C’s capital share 18,000

Change in profit sharing ratio among the existing partners

Sometimes,the existing partners may decide to change their profit sharing ratio.in such a case ,those , who gain must compensate the others who have made the sacrifice on account of change in profit sharing ratio.

Ex: A and B, with PSR of 2:4, they change PSR to 3:2, the Goodwill is valued at 60,000

Goodwill as per old PSR – A -20000, B – 40000

Goodwill as per New PSR – A -36000, B – 24000

Gain of A(36000-20000=16000) , Sacrifice of B(40000-24000 = 16000)

Adjusting Journal entry:-

A’s capital a/c Dr – 16000

To B’s capital A/c 16000

Questions

Q 50 – Mohan and Mohammed shared profits and losses in the ratio of 3:2. With effect from 1 st january 2011, they agreed to share the profits in the ratio of 5:3.The Goodwill of the firm was valued at Rs.80,000. Make the necessary adjustment entry.

Ans :Mohan’s capital A/c Dr 2000 – Mohammed’s Capital A/c 2000

Previous year questions : Click here