Reconstitution of a partnership Firm – Retirement and Death of a Partner

When the retirement or death of a Partner, the existing partnership deed comes to an end and a new partnership deed prepared for the reconstituted firm.The firm will continue its business with new terms and conditions.

ഒരു പങ്കാളിത്ത സ്ഥാപനത്തിലെ ഏതെങ്കിലും പങ്കാളിയുടെ വിരമിക്കൽ അല്ലെങ്കിൽ മരണം മൂലം നിലവിലുള്ള പങ്കാളിത്ത ഉടമ്പടി അവസാനിക്കുകയും പുതിയ ഒരു പങ്കാളിത്ത ഉടമ്പടി നിലവിൽ വരികയും ചെയ്യും

Retirement of a Partner

A partner’s withdrawal from the business with the consent of other partners or as per the provisions or partnership deed or by giving notice of retirement is called retirement.

ഒരു പങ്കാളി നിലവിൽ നടന്നുകൊണ്ടിരിക്കുന്ന ഒരു പങ്കാളിത്ത സ്ഥാപനത്തിൽ നിന്നും മറ്റുള്ള പങ്കാളികളുടെ അനുമതിയോടുകൂടെ പിൻവാങ്ങുന്ന തന്നെയാണ് വിരമിക്കൽ ഉദ്ദേശിക്കുന്നത്

Accounting Treatment on Retirement

- Change in profit sharing ratio

- Calculation of gaining ratio

- Adjustment regarding goodwill

- Adjustment of reserves and accumulated profit or losses

- Revaluation of assets and liabilities

- Ascertainment of profit or loss up to the date of retirement

- Calculation of total amount due to the retiring partner

- Settlement of total amount due to the retiring partner

- Adjustment of capitals of continuing partners.

1-Change in Profit Sharing Ratio

The share in the profit of the retiring partner is often acquired by the continuing partners in their profit sharing ratio, unless otherwise agreed.If the share acquired by old partners in their old PSR , the new ratio among the remaining partners will not change.

ഒരു പങ്കാളിയുടെ വിരമിക്കൽ അല്ലെങ്കിൽ മരണശേഷം സ്ഥാപനത്തിലെ ശേഷിക്കുന്ന പങ്കാളികൾ ഭാവിയിൽ ലാഭം പങ്കിടുന്ന അനുപാതമാണ് പുതിയ ലാഭ അനുപാതം. ഓരോ പങ്കാളിയുടെയും പുതിയ ലാഭ അനുപാതം അയാളുടെ പഴയ അനുപാതകവും വിരമിച്ച പങ്കാളിയിൽ നിന്നും നേടിയ അനുപാതവും കൂടിച്ചേർന്നതാണ്

Ex: A,B and C are Partners, Their PSR 3:2:1, if B retires, the New PSR of A and C is 3:1

New Profit sharing Ratio = Old ratio + Share acquired from old partner

Questions

Q 1 – Asha , Deepthi and Nisha are partners in a firm sharing profits and losses in the ratio of 3:2:1.Deepthi retires from the firm. Calculate New profit sharing ratio of continuing partners.

Note: New profits sharing ratio is calculated by striking out the share of retiring partner and bu finding out the denominator of the ratio.

Q 2 – Naveen ,Suresh and tarun are partners sharing profits and losses in the ratio of 5:3:2.Suresh retires from the firm and his share was acquired by Naveen and Tarun in the ratio of 2:1. Calculate the new profit sharing ratio of Naveen and Tarun.

Ans : 7:3

Q 3 – Sruthi, Aleena and Febina are partners in the ratio of 3 : 2 : 1. Sruthi retires and her share is acquired by the remaining partners in the ratio of 3 : 2. Calculate the new ratio.

Ans : New Ratio 19:11

Q 4 – Ameena, Fidha and Gayathri are partners sharing profits and losses in the ratio of 5 : 3 : 2. Fidha retires from the firm and her share was acquired by Ameena and Gayathri in the ratio of 2 : 1. Calculate the new ratio. (3Marks)

Ans : 7 : 3

2-Calculation of Gaining Ratio

The ratio in which the continuing partners decide to share the outgoing partner’s profit share is called gaining ratio.

നേട്ട അനുപാതം: തുടരുന്ന പങ്കാളികൾ വിരമിച്ച പങ്കാളിയുടെ വിഹിതം ഏത് അനുപാതത്തിലാണോ നേടുന്നത് ആ അനുപാതത്തെ നേട്ട അനുപാതം എന്ന് വിളിക്കുന്നു

Gaining Ratio of Contng.Partner’s = New Share – Old Share

Note: if a partner retires and the new profit sharing ratio(PSR)of the continuing partners are not given, Gaining ratio will be same as the Old Ratio.

ഒരു പങ്കാളിത്ത സ്ഥാപനത്തിലെ പങ്കാളികളുടെ അനുപാതവും അതിൽ നിന്നും വിരമിച്ച പങ്കാളിയുടെ പേരും മാത്രമേ പറയുന്നുള്ളൂ എങ്കിൽ തുടർന്നുപോകുന്ന പങ്കാളികളുടെ ലാഭ അനുപാതം പഴയ അനുപാതം തന്നെയായിരിക്കും

| Cases | Gaining Ratio | |

| 1 | No change in the relative ratio between continuing partnersചോദ്യത്തിൽ പുതിയ ലാഭ അനുപാതം തന്നിട്ടില്ലെങ്കിൽ | Same as old ratioതുടരുന്ന പങ്കാളികളുടെ പുതിയ ലാഭ അനുപാതവും നേട്ട അനുപാതവും പഴയ അനുപാതം തന്നെ ആയിരിക്കും |

| 2 | Change in the ratio between continuing partnersവിരമിക്കലിനു ശേഷം തുടരുന്ന പങ്കാളികളുടെ പുതിയ അനുപാതം തന്നിട്ടുണ്ടെങ്കിൽ | New ratio = Old ratio + Gain Gain = New ratio – Old ratio |

Questions

Q 5 – A,B and C were sharing profits in the ratio of 3:2:1. C retires from the firm. Calculate the Gaining ratio of A and B.

Q 6 – A , B and C were sharing profits in the ratio of 3:2:1. C retires from the firm. A and B decide to share future profits in the ratio of 7:5. Calculate the gaining ratio.

Ans :1:1

Q 7 – M,N and O are Partners sharing profits in the ratio of 3:4:1 .M retires and surrenders ⅔ of his share to N and the remaining share ⅓ to O. Calculate new profit sharing ratio and the gaining ratio of the remaining partners.

Ans : NPSR 3:1, GR 2:1

3-Adjustment regarding Goodwill

A retiring partner is entitled to his share of goodwill.The goodwill earned by the firm with the effort of all partners including retiring partner.He is not going to share future profits.so he has to compensate by the continuing partners in their gaining ratio.

The Good will is adjusted through the capital accounts of partners asper the accounting statndards 10(AS10)

ഒരു പങ്കാളിത്ത സ്ഥാപനത്തിൽ നിന്നും പിരിഞ്ഞു പോകുന്ന പങ്കാളിക്ക് ആ സ്ഥാപനത്തിൻറെ ഗുഡ്വിലിന്റെ ഒരു ഭാഗം ലഭിക്കാനുള്ള അവകാശം ഉണ്ട്. പിരിഞ്ഞു പോകുന്ന പങ്കാളിയുടെ ലാഭവിഹിതം തുടർന്നു പോകുന്ന പങ്കാളികൾക്കാണ് ലഭിക്കുന്നത് അതുകൊണ്ട് പിരിഞ്ഞു പോകുന്ന ആൾക്കുള്ള ഗുഡ്വിലിന്റെ വിഹിതം തുടർന്നുപോകുന്ന പങ്കാളികൾ അവരുടെ നേട്ട അനുപാതം അനുസരിച്ച് നൽകണം

The following journal entry is recorded for this purpose

Continuing Partner’s Capital A/c Dr

To Retiring partner’s capital A/c

Questions

Q 8 – X ,Y and Z are partners sharing profits in the ratio of 5:3:2. Z retires and the goodwill is valued at Rs.40,000. Give entries in the books of the firm regarding treatment of goodwill.

(Ans : X-5000,Y-3000)

Q 9 – A ,B and C are partners sharing profits in the ratio of 5:3:2. A retires and for this purpose goodwill is valued at Rs.25,000. Continuing partners agree that their new profit sharing ratio shall be equal.Record necessary journal entry.

(Ans: 5000,7500 – 12,500)

Q 10 – A , B and C are Partners sharing profits in the ratio of 3:2:1. B retired from the business and his share of profits is completely taken over by C.The goodwill of the firm is valued at Rs.30,000. Pass necessary journal entry.

Ans :c -10,b-10

Some of the continuing partners sacrifice on retirement of a partner,while others gain

ചില സന്ദർഭങ്ങളിൽ തുടർന്നുപോകുന്ന പങ്കാളികളിൽ ചിലർക്ക് അവരുടെ ലാഭവിഹിതത്തിൽ മുന്നേ ഉണ്ടായിരുന്നതിനേക്കാൾ കുറവ് ഉണ്ടാവുകയും ചില പങ്കാളികൾക്ക് നേട്ടമുണ്ടാവുകയും ചെയ്യുമ്പോൾ ലാഭവിഹിതത്തിൽ കുറവ് സംഭവിച്ച പങ്കാളികൾക്കും അവരുടെ കുറവിന് അനുപാതികമായ ഗുഡ്വിൽ ലഭിക്കുന്നതിന് അവകാശമുണ്ട്. ഏത് പങ്കാളികൾക്കാണ് നേട്ടമുണ്ടായിട്ടുള്ളത് അവരാണ് കുറവുള്ള പങ്കാളികൾക്ക് ഗുഡ്വിൽ ഷെയർ നൽകേണ്ടത്

Q 11 – Anu ,Manu, Binu and Sonu are partners sarong profits and losses in the ratio of 4:3:2:1. Binu retires from the firm and the continuing partners decide to change their profits sharing ratio in to equal.Goodwill of the firm was valued at Rs.2,40,000.Pass necessary journal entry for goodwill treatment.

Ans – Manu – 8000,

Sonu – 56000

To Anu – 16000

Binu – 48000.

Goodwill already in the books.

If Goodwill is already appearing in the books at the time of retirement of a partner,the same should be written off by passing the following entry

All Partner’s capital A/c Dr

To Goodwilll A/c

(Goodwill existing in the books written off by debiting all partners in the old ratio)

ഒരു പങ്കാളി പിരിഞ്ഞു പോകുന്ന സമയത്ത് ആ സ്ഥാപനത്തിൻറെ ബാലൻസ് ഷീറ്റിൽ ഗുഡ്വിൽ എന്നു പറഞ്ഞുകൊണ്ട് ഒരു സംഖ്യ ഉണ്ടാവുമ്പോൾ ആ ഗുഡ്വിൽ എല്ലാ പാർണേഴ്സിന്റെയും ക്യാപിറ്റൽ അക്കൗണ്ടിൽ എഴുതി തള്ളേണ്ടതാണ്. തുടർന്ന് പിരിഞ്ഞു പോകുന്ന പങ്കാളിയുടെ ഗുഡ്വിലിന്റെ ക്രമീകരണം കാണിക്കേണ്ടതാണ്

| When Goodwill is not appearing in the books | When goodwill is already appearing in the books |

| In this Case retiring or deceased partner’s capital account is to be credited with his share of Goodwill Gaining Partner’s Capital A/c Dr To Retiring/Deceased Part: Capital Ac (Share of Goodwill transferred to Retiring Part: capital A/c in Gaining ratio)വിരമിക്കലിന്റെ സമയത്തു ബാലൻസ്ഷീറ്റിൽ ഗുഡ്വിൽ ഇല്ലെങ്കിൽ പിരിഞ്ഞു പോകുന്ന പങ്കാളിയുടെ ഗുഡ്വിൽ ക്രമീകരണം മാത്രം മതിയാവും | In this case Old Goodwill should be written off among all partners in their Old ratioവിരമിക്കലിന്റെ സമയത്തു ബാലൻസ്ഷീറ്റിൽ ഗുഡ്വിൽ ഉണ്ടെങ്കിൽ അവ എല്ലാ പങ്കാളികളുടെയും മൂലധന അക്കൗണ്ടിൽ എഴുതി തള്ളേണ്ടതാണ് Old Goodwill Written offAll partners cap: A/c Dr To Goodwill A/c (Existing GW) New Goodwill Gaining Partner’s Capital A/c Dr To Retiring/Deceased Part: Capital Ac (Share of Goodwill transferred to Retiring Part: capital A/c in Gaining ratio) |

Q 12 – Neeraj, Nima and Aswin are partners sharing profits in the ratio of 4:3:2′ Goodwill is appearing in the books at a value of Rs.45,000. Nima retires. on retirement, goodwill of the firm is valued at Rs. 90,000. Neeraj and Aswin decided to share future profits in the ratio of 3:2 and also not to show goodwill in the books. Give journal entries.

Ans : Neeraj – 20000

Nima – 15000

Aswin – 10000

To goodwill a/c – 45000

Neeraj – 14000

Aswin – 16000

To Nima – 30000

Q – 13 A,B and C were partners sharing profits and losses in the ratio of 4:3:3 . B retires and the Goodwill of the firm is valued at 25000. Assuming that A and C will share the future profits in the ratio of 3:2. Pass the journal entries in each of the following alternative cases

Case A: When no goodwill account appears in the books.

Case B: When Goodwill account appears in the books at Rs.10000

(Ans:A-4,B-3,C-3,GW-10,A-5,C-2.5,B-7.5)

Hidden Goodwill

Some times,a firm may agree to settle the retiring partner by making a lumpsum payment.The amount paid may be more than what is due to him based on his capital a/c after all adjustment.(share of accumulated profit,revaluation profit etc).Then the excess paid shall be treated as his share of goodwill.

പിരിഞ്ഞുപോകുന്ന പങ്കാളിയുടെ ക്യാപിറ്റൽ അക്കൗണ്ടിൽ ഉള്ളതിനേക്കാളും കൂടുതലായി തുക പങ്കാളിക്ക് നൽകുകയാണെങ്കിൽ ആ കൂടുതലായി നൽകുന്ന സംഖ്യയാണ് ഇവിടെ ഗുഡ് വിൽ

Questions

Q 14 – A ,B and C are partners sharing profits in the ratio of 3:2:1. C retires from the firm.The balance in his capital account after making all adjustments (reserve and revaluation of assets and liabilities) comes to Rs.1,20,000. A and B agreed to pay C Rs.1,50,000 in full settlement of his account. Calculate the value of goodwill and write the journal entry for the same.

Ans: Hidden goodwill -30000)

Q 15 – Gupta,Agarwal and Goel were partners sharing profits in the ratio of 3:2:1. Agarwal retires on 01-01-2022. After all necessary adjustments (except goodwill) his capital was worked out to 500000.However his account was settled by paying off Rs.560000 .Pass necessary journal entry of the treatment of Goodwill.

(Ans : Gupta’s Capital A/c Dr 40000, Goel’s Capital A/c Dr 20000, To Agarwal’s Capital A/c 60000)

4-Adjustment of reserve and accumulated profit/loss

General reserve and P&L a/c credit balance and unused reserve like workmen’s compensation reserve (appearing on the liability side of B/S) should be transferred to all the partners capital a/c in the old PSR.

ഒരു പങ്കാളിത്ത സ്ഥാപനത്തിൻറെ ബാലൻ ഷീറ്റിൽ കാണിക്കുന്ന നീക്കിയിരിപ്പ്, വിതരണം ചെയ്യാത്ത ലാഭം ,ഉപയോഗിക്കപ്പെടാത്ത ഫണ്ടുകൾ തുടങ്ങിയവ എല്ലാ പങ്കാളികളുടെയും മൂലധന അക്കൗണ്ടിലേക്ക് പഴയ അനുപാതത്തിൽ വരവ് വയ്ക്കേണ്ടതാണ്

Journal entry

General reserve a/c Dr

Workmen’s compensation reserve a/c Dr

Profit and loss a/c Dr

To All Partners capital A/c (Individually in Old PSR)

*Similarly accumulated losses should be written off by transferring caital a/c

ബാലൻസ്ഷീറ്റിൽ കാണിക്കുന്ന നഷ്ടവും പാർണേഴ്സിന്റെ ക്യാപിറ്റൽ അക്കൗണ്ടിൽ ഡെബിറ്റ് ചെയ്യേണ്ടതാണ്

Partners capital a/c Dr

To P&L a/c

(If reserve or P&L a/c balance transferred to old partners capital a/c, it should not be shown again in the new B/S prepared after the retirement of Partner)

ജനറൽ റിസർവ് ലാഭം തുടങ്ങിയവ പങ്കാളികളുടെ ക്യാപിറ്റൽ അക്കൗണ്ടിൽ വരവ് കഴിഞ്ഞാൽ പങ്കാളിയുടെ വിരമിക്കലിനു ശേഷം തയ്യാറാക്കുന്ന ബാലൻസ് ഷീറ്റിൽ ഇവ കാണിക്കേണ്ടതില്ല

Alternatively ,only retiring partners share in General reserve and P&L may be credited or debited to his capital a/c

ജനറൽ റിസർവ് വിതരണം ചെയ്യാത്ത ലാഭം തുടങ്ങിയവ മുഴുവൻ പങ്കാളികൾക്കും വിതരണം ചെയ്യുന്നതിന് പകരം റിട്ടയർ ചെയ്തു പോകുന്ന പങ്കാളിക്ക് മാത്രമായും കൈമാറാം ബാക്കിയുള്ള തുക വിരമിക്കലിനു ശേഷം തയ്യാറാക്കുന്ന ബാലൻസ് ഷീറ്റിൽ കാണിക്കേണ്ടതാണ്

In such a case:-

1-For transferring retiring partner’s share of reserve or accumulated profit

Reserve /accumulated profit A/c Dr

To retiring partners capital a/c

2-Transferring loss

Retiring partners capital a/c Dr

To P&L a/c

Note: The amount of reserve and P&L a/c balance should be shown in new B/S after deducting retiring partner’s share.

These a/c balance should be transferred to partners capital a/c even if the problem is silent about it.

ജനറൽ റിസർവ് വിതരണം ചെയ്യാത്ത ലാഭം തുടങ്ങിയവയെപ്പറ്റി ചോദ്യത്തിൽ നിർദ്ദേശങ്ങൾ ഒന്നും പറയുന്നില്ല എങ്കിൽപോലും ഈ അഡ്ജസ്റ്റ് മെൻറ് എൻട്രികൾ കാണിക്കേണ്ടതാണ്

| Cases | Journal Entries | Balance sheet effect |

| General Reserve,unused reserve and Profit transferred to all partners capital accounts | General reserve A/c Dr P & L A/c Dr To All Partners Cap. A/c | The amount will not appear in the Balance Sheet |

| If Loss | All Partner’s Cap: A/c Dr To P& L A/c | |

| General Reserve and Profit transferred to Retiring partner’s share only | General Reserve A/c Dr P & L A/c Dr To Reti: partner’s Cap: A/c | Balance amount will appear in the Balance sheet Total Amount – xxx Less :Retiring part: Share – xxx Balance amount to be shown in B/S |

| If Loss | Retiring Part: Cap. A/c Dr To P& L A/c |

Questions

Q 16 – R, S and T are partners sharing profits and losses in the ratio of 2:2:1. S decided to retire from the firm and other partners decided to share future in the same relative proportions as before. Final accounts prepared at the time of retirement showed the following:

General reserve – Rs.16,000

Employees’ compensation fund – Rs.9000

Pass journal entries to record the adjustment of reserve and employees’ compensation fund assuming that there is no claim for employees compensation.

Q 17 – A, B and C are partners sharing profits in the ratio of 5:3:2 . A retired from the firm. On the date of retirement the firm’s balance sheet shows

Profit and loss account – Rs.20,000 ( On asset side )

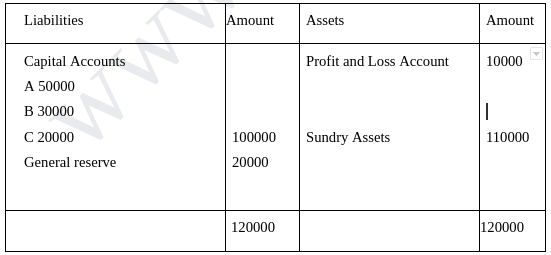

Q 18 A,B and C are Partners sharing profits in the ratio of 3:1:1. Their balance sheet as on 31st Dec.2021 was as under

C retires on 1st jan 2022.Pass necessary journal entry regarding accumulated profits or loss if any.

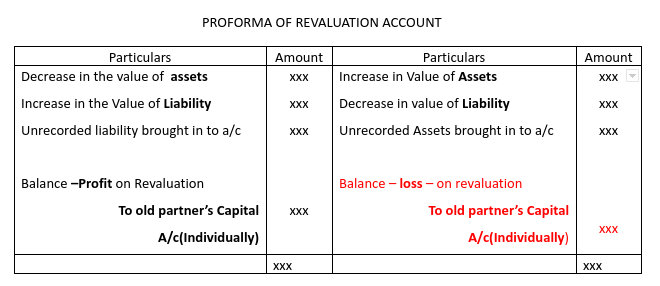

5-Revaluation of Assets and liabilities

The assets and liabilities should be revalued on the same as in the case of admission.A revaluation a/c is prepared for this purpose.The profit or loiss on revaluation is transferred to all the partner’s capital accounts,including retiring partnerscapital a/cs in their old profit sharing ratio.

ഒരു പങ്കാളി വിരമിക്കുകയോ മരണപ്പെടുകയോ ചെയ്യുന്ന സമയത്ത് ആ സ്ഥാപനത്തിൻറെ മുഴുവൻ ആസ്തികളും ബാധ്യതകളും പുനർ മൂല്യനിർണയം നടത്തുകയും അത് പ്രകാരം ഉണ്ടാവുന്ന ലാഭമോ നഷ്ടമോ മുഴുവൻ പങ്കാളികൾക്കും അവരുടെ ലാഭനഷ്ട അനുപാതമനുസരിച്ച് വീതം വയ്ക്കേണ്ടതാണ്

Journal entries

1-For increae in the value of assets

Assets A/c Dr

To Revaluation A/c

2-For decrease in the value of assets

Reavaluation a/c Dr

To Asset a/c

3-For Increase in the value of liability

Revaluation a/c Dr

To liability a/c

4-For decrease in the value of liability

Liability a/c Dr

To revaluation a/c

5-For transferring revaluation profit to partners capital a/c( balancing figure)

Revaluation a/c Dr

To All Partners capital a/c (individually including retiring partner)

6-if loss,

All Partners capital a/c

To revaluation a/c

After effect of Revaluation

Assets and liabilities will now be shown at their revised values in the balance sheet prepared immediately after admission of the new partner.

വിരമിക്കലിനു ശേഷം തയ്യാറാക്കുന്ന ബാലൻസ് ഷീറ്റിൽ ആസ്തികളും ബാധ്യതകളും പുനർ മൂല്യനിർണയം നടത്തിയിട്ടുള്ള തുകയിലാണ് കാണിക്കേണ്ടത്

Questions

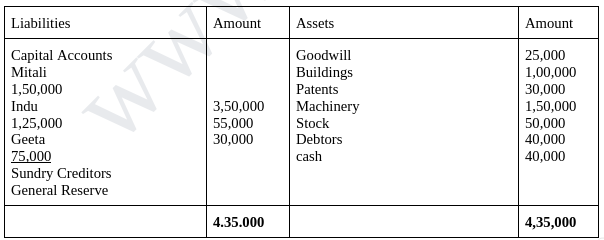

Q 19 – Mitali, Indu and Geeta are partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On March 31, 2017, their Balance Sheet was as under:

Geeta retires on the above date. It was agreed that Machinery be valued at Rs.1,40,000; Patents at Rs. 40,000; and Buildings at Rs. 1,25,000. Record the necessary journal entries for the above adjustment sand prepare the Revaluation Account.

(Ans : Revaluation profit :12500,7500,5000)

(Ans : Revaluation profit :12500,7500,5000)

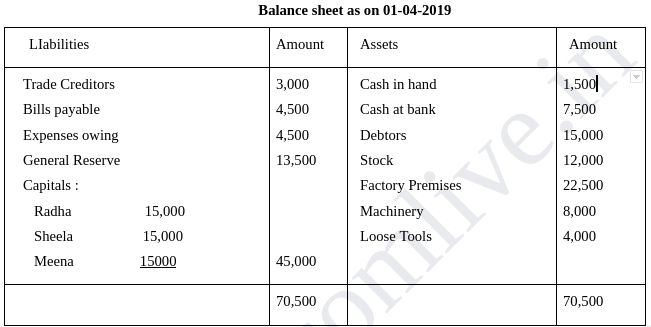

Q 20 – Radha, Sheela and Meena were in partnership sharing profits and losses in the proportion of 3:2:1. On April 1, 2019, Sheela retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

a) Goodwill of the firm was valued at Rs. 13,500.

b) Expenses owing to be brought down to Rs. 3,750.

c) Machinery and Loose Tools are to be valued at 10% less than their book value.

d) Factory premises are to be revalued at Rs. 24,300.

Prepare:

1. Revaluation account

2. Partner’s capital accounts and

3. Balance sheet of the firm after retirement of Sheela.

(Ans : Profit on Revaluation Rs. 1,350, Balance of Capital Accounts: Radha Rs. 19,050 and Meena Rs. 16,350, Balance Sheet Total = Rs. 71,100).

6-Ascertainment of Profit/loss upto the date of retirement / When Partner Retires in the Middle of the Year

If a partner retires on any day other than closing day of the accounting year ,his sare of profit should be ascertained for the period from the date of last balance sheet to the date of retirement.

ഒരു പങ്കാളി ഒരു ധനകാര്യ വർഷത്തിന്റെ ഇടക്കാലത്താണ് വിരമിക്കുകയോ മരണപ്പെടുകയോ ചെയ്താൽ അദ്ദേഹത്തിന് തൊട്ടു മുന്നേ തയ്യാറാക്കിയിട്ടുള്ള ബാലൻ ഷീറ്റ് മുതൽ അയാൾ മരണപ്പെടുകയോ വിരമിക്കുകയോ ചെയ്യുന്നതു വരെയുള്ള കാലയളവിനുള്ള ലാഭമോ നഷ്ടമോ കണക്കുകൂട്ടി നൽകേണ്ടതുണ്ട്

ഈ ലാഭം കണക്കാക്കുന്നത് മുൻവർഷങ്ങളിലുള്ള ലാഭത്തിന്റെ ആവറേജ് അനുസരിച്ചു അതല്ലെങ്കിൽ തൊട്ടു മുന്നേയുള്ള വർഷത്തെ ലാഭത്തെ മാത്രം അടിസ്ഥാനമാക്കിയോ കണക്കാക്കാം

Retiring partner’s share of profit will be calculated the following way

- Calculate the average profit of required years from the given details

- Reduce average annual profit for the period up to the date of retirement of partner.

- Find out the share of the retiring partner.

Note :some times ,profit up to the date of retirement may be based on previous year’s profit alone.

Retiring partner’s share of Profit = Average profit X Proportionate Period X Share of Deceased/Retiring Partner

Journal entries

In case of Profit:-

Profit & loss suspense A/c Dr

To Retiring partner’s Capital A/c.

In case of loss:-

Retiring partner’s capital A/c Dr

To P&L suspense A/c

Questions

Q 21 – A ,B and C are partners in a firm and they close their books on December 31 st every year.They are sharing profits and losses in the ratio of 3:2:1.The partnership deed provides that if a partner retires from the firm during the course of an accounting year,his share of profit from the date of last balance sheet to the date of retirement should be calculated on the basis of the average profit of the last three completed years.On 1st april 2009 B retires from the firm.The profits of the firm during the years 2001,2002 and 2003 were Rs.12,500, Rs.8,500 and Rs.6,000 respectively.Write the journal entry to record the share of profit of the retiring partner for the year 2009.

(Ans:p&l Suspense A/c Dr to B’s Capital A/c 750)

7-Calculation of Total Amount Due to retiring partner

The total amount due to retiring partner is determined by preparing his capital account on the date of retirement.Retiring partners capital a/c shall have the following items.

പിരിഞ്ഞു പോവുകയോ മരണപ്പെടുകയോ ചെയ്യുന്ന പങ്കാളിക്ക് നൽകാനുള്ള തുക കണക്കാക്കുന്നത് അദ്ദേഹത്തിൻറെ ക്യാപ്പിറ്റൽ അക്കൗണ്ട് തയ്യാറാക്കിയിട്ടാണ്.

Note :If it shows a debit balance it means the amount payable by retiring partner to the firm.

ക്യാപ്പിറ്റൽ അക്കൗണ്ടിൽ ക്രെഡിറ്റ് ബാലൻസ് ആണ് കാണിക്കുന്നതെങ്കിൽ ആ തുക പാർട്ണർക്ക് ലഭിക്കാനുള്ളതും ഡെബിറ്റ് ബാലൻസ് ആണ് കാണിക്കുന്നതെങ്കിൽ പങ്കാളി ആ തുക സ്ഥാപനത്തിന് നൽകേണ്ടതുമാണ്

When capital accounts are maintained according to fixed capital method all items are posted in current account of the retiring partner .The final balance in the current a/c is then transferred to his capital A/c.

Questions

Q 22 – Ramesh is a partner in a firm with ⅕ th share in profits and losses.The firm closes its books on 31 st december every year,on which date his capital account showed a credit balance of Rs.34,000. On 1st july 2011 , Ramesh decided to retire and on that date goodwill was valued at Rs.35,000.The partnership provides that if a partner retires from the firm during the course of an accounting year ,his share of profit from the date of last balance sheet to the date of retirement should be calculated on the basis of average profit of the last three completed years.Profits for 2008 ,2009 and 2010 were Rs.14,000,rs.22,000 and Rs.24,000 respectively.The books of the firm showed a balance of Rs.15,000 in general reserve account.Ramesh withdrawn Rs.3000 from the business during the year 2011.Interest on drawings comes to Rs.200 for the interim period.Interest on capital and salary payable to him from the date of last balance sheet to the date of retirement was Rs.2,100 and Rs.3,000 respectively.

Calculate the total amount due to Ramesh on retirement.

(Ans:47900)

7-Settlement of total Amount due to the Retiring Partner

The amount due to the retiring partner is settled as per the provisions of partnership deed.It may be paid in full at the time of retirement or due amount transferred to retiring partner’s loan account and paid in instalments together with interest.

A – Lumpsum payment

പിരിഞ്ഞു പോവുകയോ മരണപ്പെട്ടു ചെയ്ത പങ്കാളിയുടെ മൂലധന അക്കൗണ്ടിൽ കാണിക്കുന്ന തുക അദ്ദേഹത്തിന് ഒറ്റത്തവണയായി നൽകുമ്പോൾ

| Amount Payable to Retiring Partner | Journal Entries |

| Payment to retiring partner in full | Retiring partner’s capital account Dr To Cash / Bank |

Journal entries

- When retiring partner is paid cash in full

Retiring partner’s capital A/c Dr

To Cash/ Bank A/c

B – Payment in Instalmets

The out going partner can claim proportionate share in the profit earned on the amount due to him from the date of retirement to the date of final payment or interest @ 6% per annum at his option.

Each Instalemt consists of :

a – Principal Amount

b – Interest at an agreed rate.

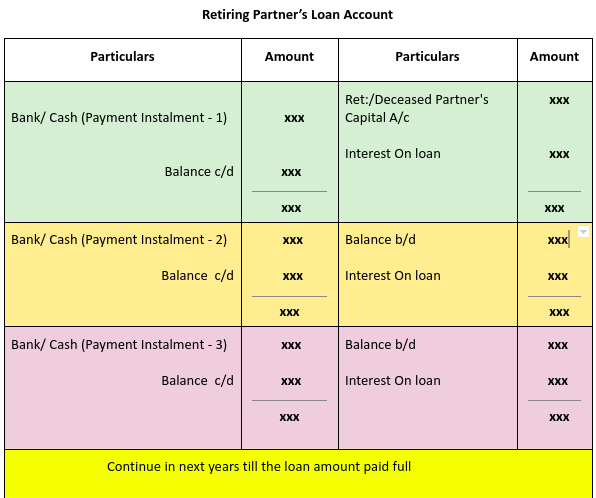

Interest due on loan is credited to loan account and instalments are paid at agreed intervals, say two,three or four years.

പിരിഞ്ഞു പോകുന്നതോ മരണപ്പെട്ടു പോകുന്നതോ ആയ പങ്കാളിക്ക് നൽകാനുള്ള തുക ഒറ്റത്തവണയായി സ്ഥാപനത്തിന് നൽകാൻ കഴിയാതെ വരുമ്പോൾ ആ തുക പിരിഞ്ഞുപോയ പങ്കാളിയുടെ ലോൺ അക്കൗണ്ടിലേക്ക് മാറ്റുകയും ലോൺ അക്കൗണ്ടിൽ ബാക്കിയുള്ള സംഖ്യക്ക് വർഷാവസാനം നിശ്ചിത ശതമാനം പലിശയോടുകൂടെ തുടർന്നുള്ള വർഷങ്ങളിൽ ഗഡുക്കളായി തിരികെ നൽകുകയും ചെയ്യും

Note: Balance of loan amount will be shown on the liability side of the balance after retirement.

| Amount Payable to Retiring Partner | Journal Entries |

| Transfer to Retiring partners loan Account | Retiring partner’s capital a/c Dr To Retiring partner’s loan account. |

| When due Interest | Interest on Loan A/c Dr To Retiring Partner’s loan A/c |

| For payment of Installment with Interest | Retiring partners Loan A/c Dr To cash / Bank A/c |

Note : last two entries will be repeated till the loan is fully paid.

2-When retiring partner is partly paid in cash and the remaining amount treated as loan

Retiring partners capital A/c Dr

To cash/Bank A/c

To Retiring partners Loan A/c

| Amount Payable to Retiring Partner | Journal Entries |

| Part Payment to retiring partner’s Capital Account | Retiring partner’s capital account Dr (Total amount due) To Cash / Bank (Part payment made) To Ret.partner’s Loan A/c (Balance amount as loan) |

3-When retiring partner’s whole amount is transferred to his loan account

Retiring Partner’s capital A/c Dr

To Retiring partners Loan A/c

4-When loan A/c is settled by paying in instalment include Principal and interest

a-When interest due

Interest on loan A/c Dr

To Retiring partners Loan A/c

b-Payment of Instalments

Retiring partners Loan A/c

To Cash/Bank A/c

(entries ‘a’ and ‘b’ continue in next years till the loan amount paid full)

Questions

Q 23 – A, B and C are partners in a firm.B retires from the firm on 1st January 2014.On his date of retirement ,Rs.60,000 is due to him. A and C promise to pay in three equal annual installments together with interest at 12% per annum.Prepare B’s loan Account for the three years.

Q 24 -X ,Y and Z are partners in a firm.Y retires and on the date of retirement Rs.60,000 becomes due to him. X and Z promise to pay him in instalments every year at the end of the year.Prepare Y’s loan account in the following cases.

1 – When payments is made in 4 yearly instalments plus interest @12% p.a. On the unpaid balance.

2 – When they agree to pay 3 yearly instalments of Rs.20,000 including interest @12% on the outstanding balance during the first three years and balance including interest in the 4 th year.

8-Adjustment of capitals of continuing Partners

Sometimes ,after the retirement of a partner ,the remaining partners decide to adjust their capitals.Such adjustments can be done in the following ways:-

ചിലപ്പോൾ പങ്കാളിയുടെ വിരമിക്കലിനു ശേഷം നിലവിലുള്ള പങ്കാളികൾ അവരുടെ ക്യാപ്പിറ്റൽ അഡ്ജസ്റ്റ്മെന്റ് ചെയ്യാറുണ്ട്

- Fix a total capital for the firm and divide it among the continuing partners in their new profit sharing ratio.

സ്ഥാപനത്തിൻറെ ക്യാപ്പിറ്റൽ പുതുതായി നിർണയിക്കുകയും ആ ക്യാപ്പിറ്റൽ തുടർന്നുപോകുന്ന പങ്കാളികളുടെ ലാഭവിഹിത അനുസരിച്ച് ഷെയർ ചെയ്യുകയും അതിൽ അഡ്ജസ്റ്റ്മെന്റ് നടത്തുകയും ചെയ്യുക

Ex: A and B are partners whose Profit Sharing Ratio is 2:3, they fixed Total capital as 50000

| A | B | |

| Existing capital balance | 15000 | 33000 |

| Required capital (Fixed capital X New PSR)50000*PSR | 20000 | 30000 |

| Shortage/Excess | 5000 – shortage | 3000 – excess |

A should bring Rs 5000 as additional capital, B can withdraw Rs 3000

Journal entries :

Cash/bank A/c Dr 5000

To A’s capital A/c Dr 5000

To B’s Capital A/c 3000

To Cash/ Bank A/c 3000

Questions

Q 25 – A,B and C are Partners sharing profits in the ratio of 4:3:2. B retires , A and C fix the entire capital of the new firm at Rs.54,000 in the profit sharing ratio.The capital accounts of A and C shows balance of Rs.40,300 and Rs.15,300 respectively immediately after B’s retirement. Show the adjustment of capital account if

A – Partners are to bring in cash deficiency or to withdraw the surplus ,or

B – Partner’s capitals are adjusted through current accounts.

(Ans : A – 4300 withdraw, B bring 2700, Through current account – Partners current Account instead of cash A/c)

Q 26 – Mohit, Neeraj and Sohan are partners in a firm sharing profits in the ratio of 2 : 1 : 1. Neeraj retires and Mohit and Sohan decided that the capital of the new firm will be fixed at Rs. 1,20,000. The capital accounts of Mohit and Sohan show a credit balance of Rs. 82,000 and Rs. 41,000 respectively after making all the adjustments. Calculate the actual cash to be paid off or to be brought in by the continuing partners and pass the necessary journal entries.

(Ans :Excess capital withdrawn by M-2000, S-1000)

- When the total capital of new firm is not specified – here total is capital is calculated by adding continuing partners capital balances .Here total capital is not blindly fixed.

ഇവിടെ ഒരു സംഖ്യ ക്യാപ്പിറ്റൽ ആയിട്ട് നിർണയിക്കുന്നതിന് പകരം തുടർന്നുപോകുന്ന പങ്കാളികളുടെ ക്യാപിറ്റൽ കളുടെ തുക കൂട്ടി അവ പുതിയ ലാഭവിഹിതം അനുസരിച്ച് ഷെയർ ചെയ്യുകയും ചെയ്യുന്നു

With the above example ,Total capital of A & B is , = 15000+33000 = 48000,instead of Rs 50000 specified in question.

Questions

Q 27 – Asha, Deepa and Lata are partners in a firm sharing profits in the ratio of 3 : 2 : 1. Deepa retires. After making all adjustments relating to revaluation, goodwill and accumulated profit etc., the capital accounts of Asha and Lata showed a credit balance of Rs. 1,60,000 and Rs. 80,000 respectively. It was decided to adjust the capitals of Asha and Lata in their new profit sharing ratio. You are required to calculate the new capitals of the partners and record necessary journal entries for bringing in or withdrawal of the necessary amounts involved.

(Ans : 20000 brought by asha , 20000 withdrawn by lata)

- When the amount payable to retiring partner will be contributed by continuing partners in such a way that their capitals are adjusted – here the total capital is calculated by adding all partners capital balances including retiring partner.

. പിരിഞ്ഞുപോകുന്ന കൊടുക്കാനുള്ള തുക തുടർന്നുവരുന്ന പങ്കാളികൾ അവരുടെ ക്യാപിറ്റൽ അഡ്ജസ്റ്റ്മെന്റിലൂടെ കൊണ്ടുവരുന്നു

Total capital = Continuing partners capital + retiring partners capital

A,B and C, are partners, their PSR is 2:3 If C retires ,his capital balance is Rs40000

Total capital is : 15000+33,000+40,000=88,000, this capital should divide among the continuing partners and bring the shortage .

Questions

Q 28 – Lalit, Pankaj and Rahul are partners sharing profits in the ratio of 4 : 3 : 3. After all adjustments, on Lalit’s retirement with respect to general reserve, goodwill and revaluation etc., the balances in their capital accounts stood at Rs. 70,000, Rs. 60,000 and Rs. 50,000 respectively. It was decided that the amount payable to Lalit will be brought by Pankaj and Rahul in such a way as to make their capitals proportionate to their profit sharing ratio. Calculate the amount to be brought by Pankaj and Rahul and record necessary journal entries for the same. Also record necessary entry for payment to Lalit.

(Ans :Bank Ac-70000, P -30000,R – 40000, L 70000 to Cash 70000)

DEATH OF A PARTNER

A partnership comes to an end on the death of any one of the partners , although the firm may continue with the remaining partners .The accounting treatment for various adjustments in case of death of a partner is similar to that of retiring partner.

Difference between Death and Retirement of a Partner

- Retirement is a planned one.death may take place at any time

- Relation of a partner with the firm voluntarily broken in case of retirement .It is automatic in case of death

- Amount payable to a retiring partner is transferred to his loan account, on death the amount due to deceased is transferred to executors account

Journal Entries

1-Amount due to deceased partner

Deceased partner’s capital A/c Dr

To Executors A/c

2- When loan A/c is settled by paying in instalment include Principal and interest

a-When interest due

Interest on loan A/c Dr

To Executors Loan A/c

b-Payment of Instalments

Executors Loan A/c

To Cash/Bank A/c

(entries ‘a’ and ‘b’ continue in next years till the loan amount paid full)

Questions

Q 29 – Following is the Balance Sheet of Lekshmi, Priya and Deepa, who share profits and losses equally.

Lekshmi died on 31st May 2017. According to the Partnership deed her legal representatives are entitled to :

(1) Balance in the capital account and undistributed profit/loss.

(2) Share of Goodwill under average profit method.

(3) Share in the profit upto the date of death based on last year Profit.

(4) Interest on capital @ 6% p.a.

The goodwill of the firm under average profit method is Rs.42,000, and profit for the year 2016-17 ` 21,600. Calculate the amount payable to Lekshmi’s legal representatives.

(Ans:56692)

Q 30 – Manu, Nithin and Sanu are partners in a firm, sharing profits in the ratio 3 : 1 : 1. Theirvcapital was :

Manu – ` 40,000

Nithin – ` 20,000

Sanu – ` 20,000

The partnership deed provided that

(a) Interest on capital was provided at 10% per annum.

(b) A joint life policy was taken by partners for ` 24,000.

(c) The goodwill of the firm is valued at ` 30,000.

(d) Sanu’s drawings for the previous year were ` 40,000.

(e) The profit of the last 3 years ending 31st December were 8,000, 6,400 and 6,000.

(f) Profit till the date of death is calculated on the basis of last three years average profit.

Sanu died on July 1, 2016. Prepare an account showing the amount payable to the representatives of Sanu.

(Ans: Debit balance 7520)

Q 31 – Gracy, Shiyana and Subisha were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Their balance sheet as on 31-03-2017 stood as follows :

Gracy died on 1-10-2017. Her legal heirs are to be settled on the following terms :

(a) Interest on capital to be provided @ 10% p.a.

(b) Profit till the date of death may be calculated on the basis of last year’s profit, which was Rs. 30,000.

Prepare the Capital Account of the deceased partner.

(Ans :76500)

Q 32 – Prakash, Rajesh and Sareesh are equal partners in a firm. Rajesh retires from the firm. On the date of retirement Rs.1,20.000 became due to him. Prakash and Sareesh promises to pay him in ‘4’ equal installments at the end of every year. plus accrued interest @ 12% p.a. on the unpaid balance.

(a) Pass journal entry for the amount due to Rajesli on the date of retirement.

(b) Prepare ‘Rajesh’s loan account’, till the amount is fully paid off.

Q 33 – Renjith,Sumesh and Aneesh are partners in a firm.Sumesh retires from the firm.On the date of retirement of Sumesh Rs.45,000 become due tohim .Renjith and Aneesh promise to pay the amount in installments.Prepare Sumesh’s loan account ,when they agree to pay three yearly installments of Rs.15,000 including interest at 12% p.a. On the outstanding balance during the first three years and the balance including interest in fourth year.

Q – 30 : P,Q and R are partners in a firm.Q retires.On his date of retirement Rs.60,000 becomes due to him.P and R promise to pay him in installments every yearat the end of the year.Prepare Q’s Loan A/c. in the following cases”

A -When the payment is made four yearly installments plus interest @12% p.a. On the unpaid balance.

B – When they agree to pay three yearly installments of Rs.20,000including interest @12% p.a. On the outstanding balance during the first three years and the balance including interest in the fourth year.

Previous year questions : Click here